New technology and scale continue to drive advancements in renewable energy. This is an exciting time for solar technology, particularly as implementation of the Inflation Reduction Act (IRA) begins. Here, we highlight some of the market and current and some future technological trends in solar energy.

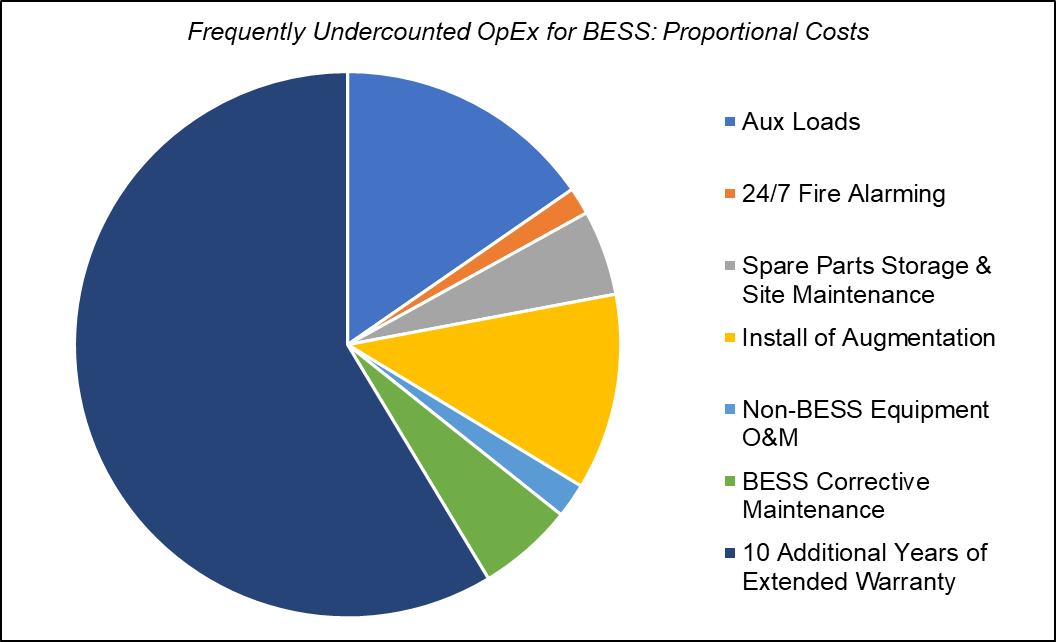

High Material Cost is Causing Strategy Adjustments for Developers

In June of 2020, previously record-low spot market prices for polysilicon began to rise, a trend we expect to continue into 2023. With it, the cost to build solar energy began to increase for the first time in a decade, and unexpectedly high procurement costs have left developers looking to reduce supply-chain and logistics cost, in part, by maximizing system capacity and size. As a result, the physical size of solar modules, along with the inverters, cables, and transformers necessary to facilitate them is increasing. Before we delve into the details, it’s important to understand the basic facts underlying new module technologies.

Mono-PERC Dominant as Bifacial Market Share Increases

In 2018, we wrote about how premium, higher-efficiency cell technologies, like monocrystalline PERC (mono-PERC) modules, were beginning to close the price gap with non-premium modules. The price gap is now non-existent, and mono-PERC cells dominated the market with a market share of 85 percent in 2021 (and likely much higher when considering only the U.S. market). Mono-PERC cells have impressive energy conversion efficiency that currently averages approximately 21 percent, and their consolidated market share has helped reduce cost at scale. In addition, roughly half of 2021 solar installations incorporated the use of bifacial modules, which only further increases efficiency of projects. Before 2020, bifacial modules only made-up approximately 15 percent of the overall module market, but is now expected to exceed 85 percent by 2032 (this should continue or even increase with continued exemption of bifacial modules from Section 201 tariffs). In brief, today’s utility-scale solar projects are now overwhelmingly using bifacial mono-PERC cell technology, considered a premium just a few years ago.

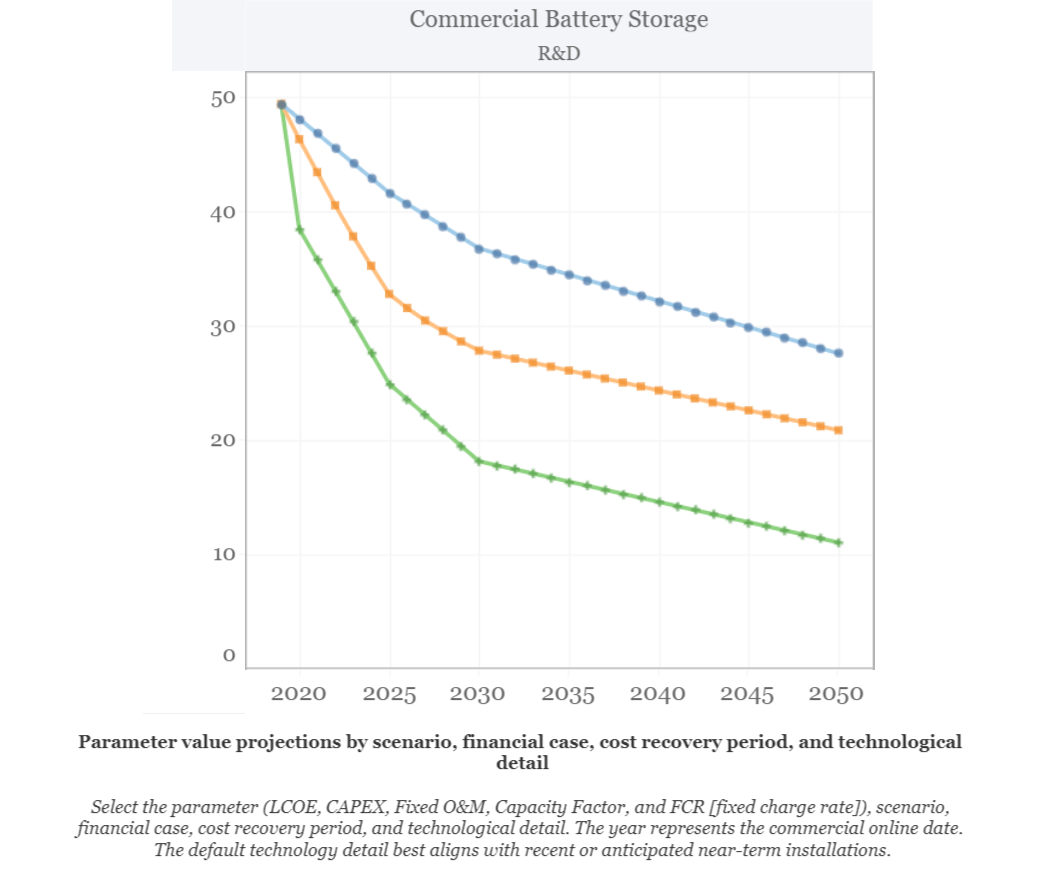

Decreasing Levelized Cost of Energy (LCOE) in the Face of Rising Build Costs

Increased module sizing has been key to bringing down the levelized cost of energy (LCOE) for solar, particularly in the utility-scale sector. In the second quarter of 2022, modules with 182 to 210 millimeters (mm) sized cells accounted for 80 percent of module shipments. The increase is notable when compared to 2018, when the previous standard 156.75 mm cells dominated the market with an approximate 90 percent market share. Developers that were installing 400 to 450 watt (W) modules in recent years are now routinely installing 600W or larger modules, and the modules with 210 mm cells alone are expected to reach 56 percent market share by 2023.

The implementation of larger-format modules results in changes to the equipment, cost, and overall layout of a site. The use of larger modules typically results in the need to upscale other equipment, such as racking systems. This can lead to an overall reduction in LCOE of the project, as developers are able build larger capacity systems using larger components that require less labor, transportation, and operations and maintenance (O&M) costs. As module sizes increase, however, installation will eventually become more difficult and single-axis trackers will require thicker foundations and torque tubes to maintain structural stability under increased wind loading. Thus, over the longer term we expect a plateau to size increase and a continued focus on efficiency improvements. In the meantime, larger-format modules are helping utility-scale projects pencil in the wake of an unusually expensive market.

What does Tomorrow’s Solar Look Like?

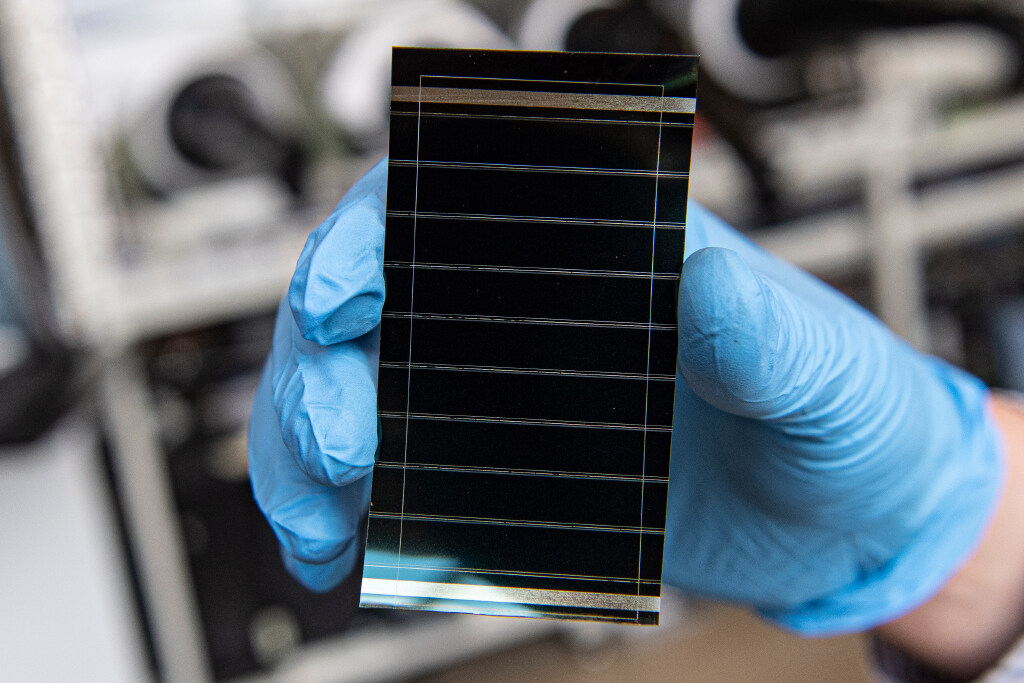

While we can expect the continued adoption of larger format bifacial modules in the near term, emerging technologies continue to seek market share in the coming years. Two versatile technologies peak our interest: perovskite-based solar cells and luminescent solar concentrators.

Perovskite solar cells are an emerging thin-film cell technology built using the calcium titanic oxide mineral perovskite rather than silicon. Following years of fast improvement, researchers recently achieved efficiencies greater than 30 percent in lab environments by combining perovskite with silicon in what are called tandem cells. This flexible, lightweight, and high-efficiency technology offers appealing potential in a variety of applications ranging from buildings to vehicles. While lab results are promising, the technology faces many barriers to commercial viability. Perovskite-based cells have long suffered a high rate of degradation, and solving the technology’s durability issues will be key to its prospects of competing with current technologies that continue to extend project lifetimes. While the technology has the potential to be relatively low cost, it has yet to pave a clear path to a commercially viable product that can be manufactured at scale.

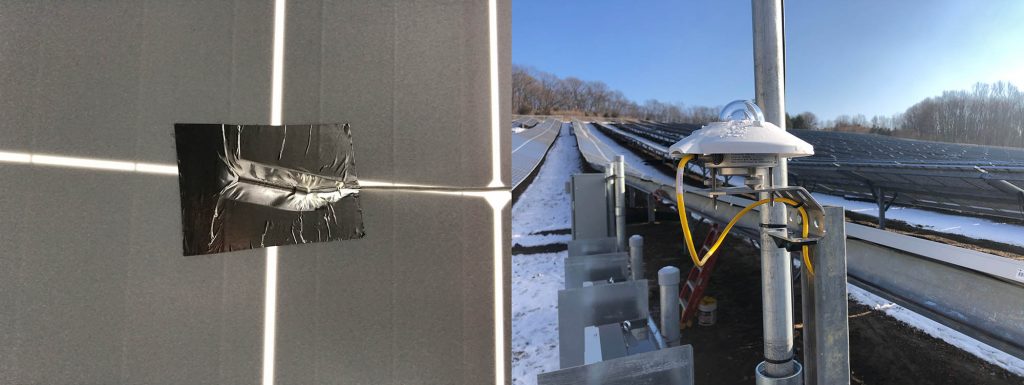

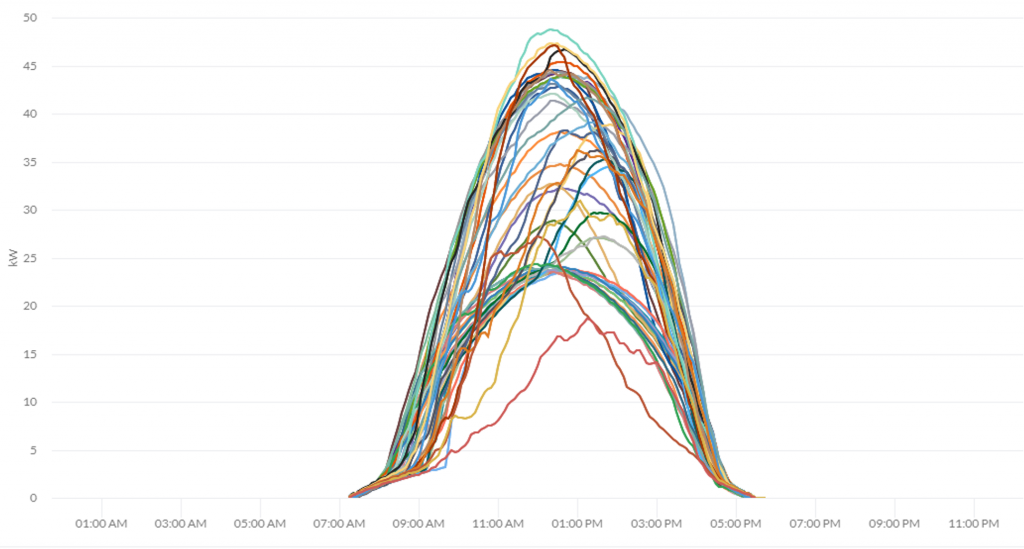

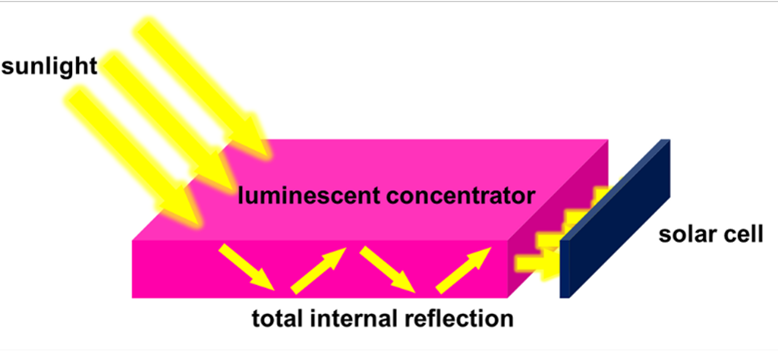

While perovskite technology is an example of a new, highly efficient solar cell that is achieving impressive results in ideal lab conditions, technologies like luminescent solar concentrators (LCSs), which use existing cell technology present an interesting near-term opportunity. In a lab testing environment, LCSs achieves ideal results by concentrating the highest magnitude of irradiance directly perpendicular to the cell. In other words, direct sunlight which is far from field conditions. LSCs, however, can efficiently convert irradiance in the field regardless of magnitude or angle of incidence through solar concentration.

LSCs look like a translucent, usually colorful, piece of plastic that glows slightly around the edges. Whereas solar modules absorb light directly into the cell at the angle the sunlight hits it, LSCs absorb incoming radiation into the material, trapping it there through a phenomenon known as total internal reflection. This trapped irradiance (concentration) is then concentrated directly in solar cells at the edge of the material, giving it the ability to harness diffuse irradiance similar to lab conditions.

Because of its ability to efficiently convert diffuse irradiance into electricity, as well as its largely transparent material, LSCs are becoming a more practical and less expensive way to integrate solar cells into applications like windows. This could allow solar generation using a building’s façade rather than just its roof. Additionally, recent breakthroughs in “quantum dot solar concentrators,” provide a longer life and a wider variety of colors for LSCs, which could lead to a clearer path for future commercial viability.

-

Scaling the solar industry at a rate necessary to succeed under the Inflation Reduction Act (IRA) will require increasingly innovative solar design and deployment. We look forward to keeping you updated as technology continues to evolve.