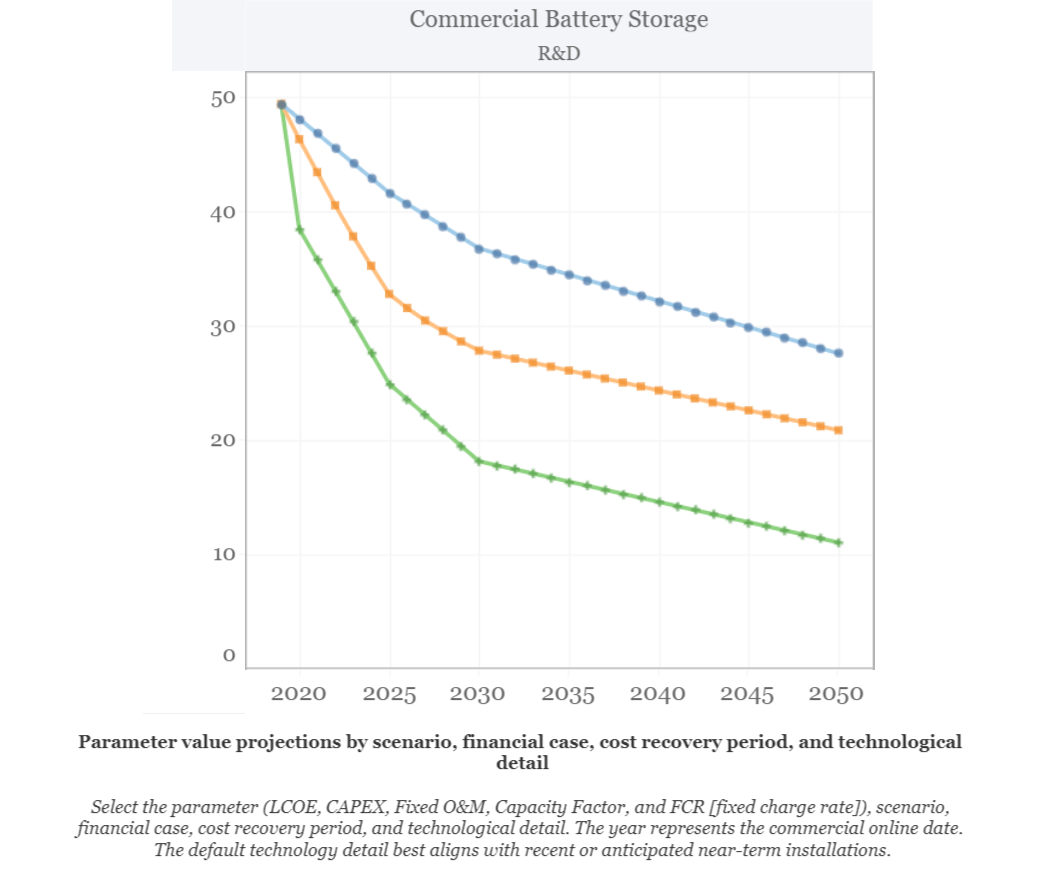

Most solar developers around the world are rushing to add lithium-ion battery storage to as many projects as possible and to update financial models to account for the added development and OpEx challenges they present. Without many operating batteries on the market, many developers and owner-operators (Sol included) are continuing to update their OpEx assumptions. Public reports, such as this 2020 NREL forecast for commercial-scale battery storage, provide forecasts for how fixed O&M costs will decline over time, but these projections are difficult for developers to integrate into project economic models without more operational data. Even the few public reports published in 2020 and 2021 include not only a range of published O&M costs—see the table below for a few examples—but also report significant uncertainty on the scope of those examples.

| 2020 O&M Cost | BESS Size | Source |

| $1.921/kWh | 100 MW / 200 MWh | Lazard’s 2020 Levelized Cost of Storage Analysis – Version 6.0 |

| $1.04 - 1.26/kWh | 1 MW/ 2 MWh - 100 MW / 200 MWh | Pacific Northwest National Laboratory 2020 Grid Energy Storage Technology Cost and Performance Assessment |

| $12.5/kWh $8.75/kWh | 60 kW – 1.2 MW / 240 kWh – 7.2 MWh 60 MW / 240 MWh | NREL Storage Futures Study |

While battery original equipment manufacturers (OEMs) and integrators can advise developers on what some of these costs might be, such as preventative maintenance or a Long-Term Services Agreement (“LTSA”) that includes an augmentation plan, many of these project costs are up to the developer to assess and to integrate into economic models. Battery energy storage systems (“BESS”) present a huge opportunity for the clean energy industry as deployment grows and hardware costs decline.

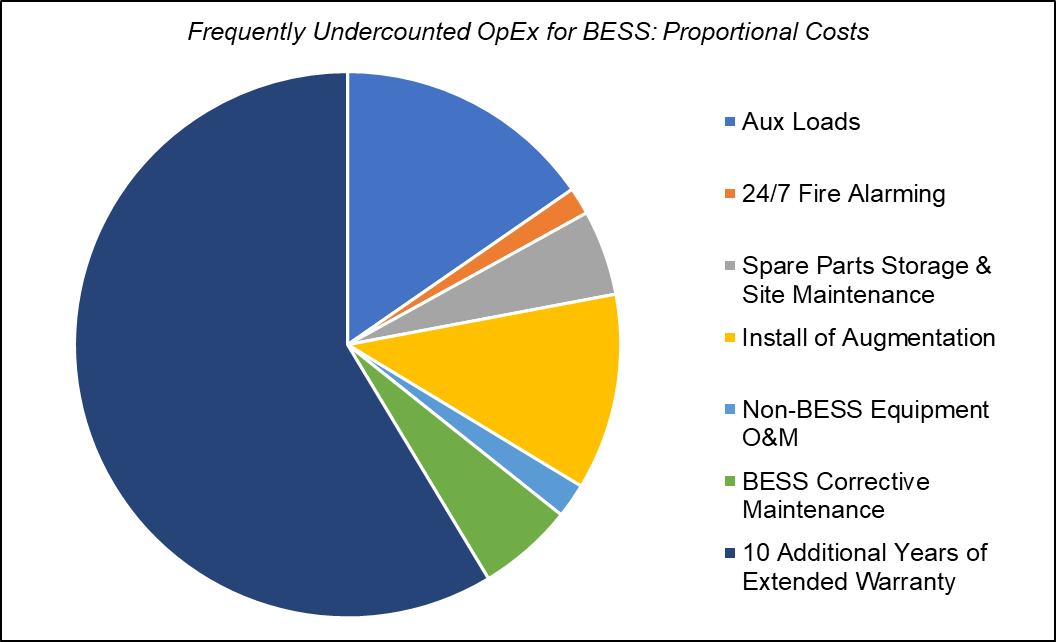

1. Auxiliary Loads: For technical and economic reasons, most often the thermal management systems and SCADA are served by a separate feeder, using retail power from the grid rather than the solar system. Auxiliary load profiles are hard to estimate and vary from project to project depending on precise cycling patterns and the applicable BESS product. Battery OEMs and integrators may not be able to provide these estimates early on, leaving developers struggling to include reasonable estimates in their models. Even Tesla Megapacks, known for their ability to use the battery’s own charge to power its thermal management system, still require some additional auxiliary loads (e.g., additional SCADA for the entire BESS). For most utility-scale battery systems, these additional auxiliary loads are separately served by their own retail meters.

2. 24/7 Emergency Alarming with the Fire Department: Many BESS integrators offer a basic preventative maintenance package that includes valuable alarming and forecasting of specific equipment deficiencies that could eventually lead to fires. The responsibility of contacting the fire department in the event of an emergency fire alarm, however, is still often passed around like a hot potato. For smaller developers without a 24/7 network operations center, this all-hours fire alarm notification requirement is something that they must be ready to cover themselves.

3. Climate-Controlled Spare Parts: Capacity Maintenance Agreements (CMA)[1] typically require the asset owner to purchase a specific list of spare parts. Make sure to ask for this list and associated costs in advance—because they can add up! However, some (e.g., the battery modules) require specific climate conditions and appropriate documentation of said conditions to maintain any applicable warranties. Luckily, they are the same as the operating modules require, so the simplest solution is to leave several empty racks and simply store the spare modules in the same enclosure as the operating battery (with a battery management system (BMS) to track conditions).

4. Install of Augmentation: The installation of the augmented BESS modules is often a forgotten scope item and uncounted cost in the initial pre-Notice to Proceed (“NTP”) financial model. Most BESS integrators are not prime construction/engineering contracting firms and treat the install and balance-of-system of the augmented BESS modules the same way as they do the initially installed modules, assuming that the developer or asset owner is responsible for install. Ensure that you don’t undercount the future cost of mobilization and lifting equipment rental. While this gives developers the flexibility to shop around for price, it leaves some uncertainty on the table as to what the cost of installing additional BESS units will be in 7–15 years. There are ways to construct the initial build with everything in place to make that mid-term augmentation as efficient to install as possible, but we are all making calculated assumptions about what the future install cost will be.

5. Non-BESS Equipment O&M: BESS integrators provide the BESS modules/enclosures, the inverters (PCS), and often the medium-voltage transformers. Beyond that, your EPC partner or in-house construction team will be procuring a much longer list of equipment, and the maintenance of this additional equipment is often a forgotten cost as well. If a BESS is paired with a solar project, the O&M provider for the solar project can typically offer this O&M for a reasonable additional cost. Alternatively, if the BESS is standalone, this additional O&M is both more expensive and can be harder to find—therefore, it is even more important to add these costs into the model early on.

6. Corrective Maintenance for Smaller BESS: For smaller BESS where a CMA doesn’t make sense economically, integrators and BESS vendors provide a wide range of contract-term services, and it can be hard to parse through different defined terms from different vendors and evaluate if they are covering equivalent scope. Most offer preventative maintenance that is explicitly mentioned in the BESS proposals, but the corrective maintenance is frequently left out of many offerings for smaller projects (or the costs are ‘TBD’ depending on the future number of corrective maintenance events) and can easily be left out of an early-stage financial model if the developer isn’t careful.

7. Extended Warranty: In addition to corrective maintenance, another sometimes-hidden cost is the warranty extension (which is typically named different ways by different OEMs). Different vendors include different warranty lengths with the system purchase, but there is typically a cost to extend beyond 15 years and often a cost to extend beyond even just 3–5 years. Failing to purchase this extended warranty for the full term of contracted revenue would leave an unthinkable scope gap that financiers won’t accept, and therefore, these warranty extensions are a need-to-have.

As the industry grows and matures, the standard OpEx assumptions for BESS projects will be easier to forecast and calculate. We are looking to add energy storage for all of our utility-scale and distributed-generation solar projects, and we are working with several customers on standalone battery opportunities. What is clear is that energy storage will continue to be a key aspect of project development and energy management going forward, and the Sol team is eager to work with our development partners and customers to create as many new opportunities as we can.

[1] A Capacity Maintenance Agreement (CMA) is a commitment by a BESS integrator to maintain a certain capacity from beginning-of-life commissioning through a full contract term (e.g., 20 years) using a combination of oversizing and augmentation.