The U.S. Congress had a busy late 2021, enacting the most significant infrastructure investment in generations, among other accomplishments. However, industry attention remains focused on the remaining half of the economic and social investment package termed “Build Back Better” (BBB) that has thus far run aground on unified Republican opposition and two Democratic holdouts. Because the legislative package is designed to pass under a budget-related process known as reconciliation that requires a simple majority for passage and is thus protected from certain filibuster, BBB could pass with unified Democratic support (and Vice President Kamala Harris’s tie-breaker vote).

Senator Joe Manchin (D-WV) is the primary block, citing myriad and shifting objections, notably the recently expired child tax credit and any meaningful carbon-reduction policy such as taxes, fees, or payments to close fossil generation. He does, however, appear open to supporting the clean energy incentives included in previous legislative drafts (Senator Sinema (D-AZ), the other holdout, appears to support the clean energy provisions already). Thus, we could see the clean energy provisions form the core of a stripped-down BBB that is able to pass by the February budget deadline. President Biden recently stated his support for this approach.

What’s Actually in the Bill?

The extension and expansion of the Investment Tax Credit (ITC) contained in previous drafts of BBB is of vital interest to the solar industry and, together with other tax policies for nuclear and carbon sequestration, could bridge the divide. As currently drafted, BBB would extend and expand the ITC for ten years and include other supportive technologies, such as storage and transmission, without which clean generation deployment is less effective in actually reducing emissions.

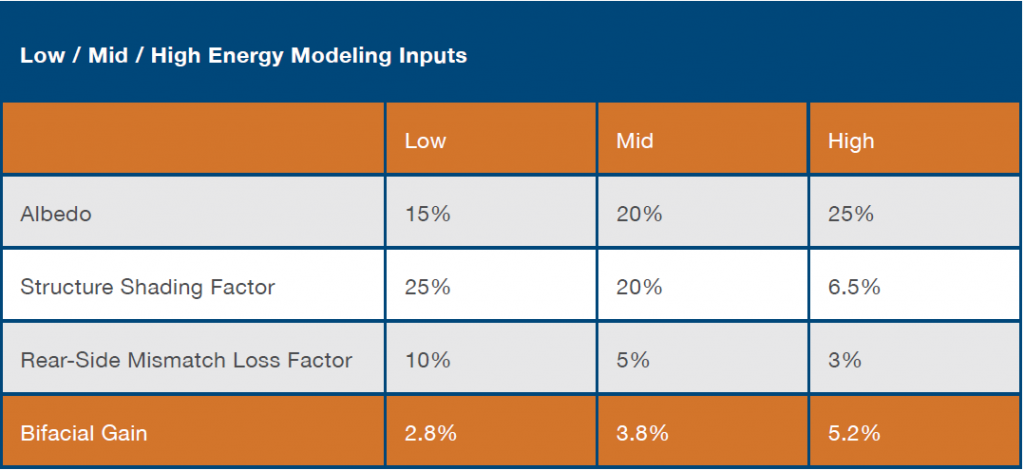

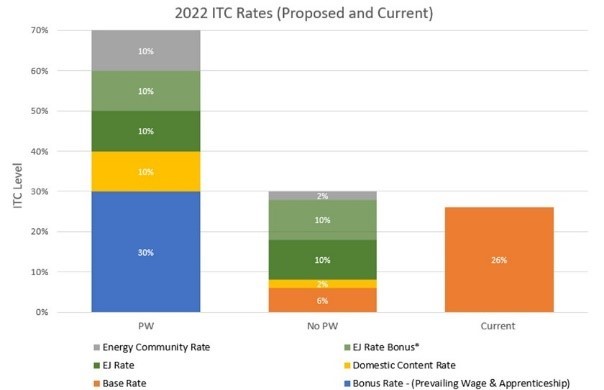

Under the BBB, the “base” ITC available to any qualifying solar project would revert to 6 percent, rising to 30 percent for projects that meet prevailing wage and apprenticeship requirements. Wage and apprenticeship requirements would apply during construction as well as for labor on repairs or alterations during the five-year ITC recapture period, unless demonstrably unavailable. As shown in the chart below, paying prevailing wages opens up much higher incentive rates.

As currently written, bonuses would be also available for sufficient use of domestic content, supporting environmental justice communities, and for facilities in qualifying “energy communities” where a coal mine or a coal-fired electric generating unit has been shut down—or will be.

Finally, two important caveats: Direct payment of the ITC is proposed for projects beginning construction after 2023 if domestic content requirements are satisfied—potentially a significant incentive for projects that struggle with traditional financing options, such as municipal utilities. Also, projects smaller than 1 MW net output would be exempt from the wage and apprenticeship requirements for the full proposed ITC.

What Already Passed?

Lost in the focus on the BBB drama are the truly transformative investments in the Infrastructure Investment and Jobs Act (IIJA) signed by President Biden on November 15, 2021, including a number of significant energy-related items. Notably to our industry, the IIJA provides significant funding and additional regulatory authority to increase electrification across transportation and building sectors and to build the regional transmission network necessary to power this shift with clean electricity.

Several provisions aim to shore up the aging electrical grid for increased electrification demand even as it is increasingly threatened by modern cybersecurity and climate change-induced extreme weather threats. These include grants to improve resiliency for weather disasters, improve grid resilience, smart grid, and for resilience and environmental protection improvements in rural areas. As much as $2.5 billion in loans are now available for the Department of Energy to support construction of nonfederal electric transmission lines and participate in the design, operation, and ownership of projects, which could alleviate some “first mover” intertia to getting new lines started. The law also requires electric utilities to promote use of demand-response and demand flexibility practices to reduce consumption of grid electricity during periods of unusually high demand, offering a significant incentive to developers who can pair solar and storage to shift solar “consumption” to match.

The new law also contains several elements designed to transform the transportation sector. The measure allocates $6.42 billion for a new program to reduce transportation-related carbon emissions, with eligible projects including truck stop electrification systems, congestion management technologies, and intelligent transportation system capital improvements. The law also offers $5 billion over five years to replace school buses with electric or zero-emission buses and $250 million for electric or low-emission ferries, bringing the benefits of clean transportation to some of the most vulnerable Americans.

The law also offers funding to other low-emission vehicles, electric vehicle charging stations, and alternative fuel infrastructure, with some funding prioritized for rural areas, low- and moderate-income neighborhoods, and communities with less access to private parking.

One final provision requires that any projects funded under the law’s energy provisions must pay prevailing wage, a requirement that we expect to continue to be in play for other publicly-supported projects under the Biden administration and increasingly at the state level, such as Illinois’s recent landmark Clean Energy Jobs Act.

How Do We Get There from Here?

As we enter 2022, the solar industry is watching intently as negotiations continue to convince Senator Manchin to make these historic and crucial investments in 21st century social, economic, and energy infrastructure. If BBB succeeds, the U.S. will be poised for unprecedented – and unprecedentedly equitable – growth in clean energy and domestic manufacturing, setting up decades of increasingly sustainable growth and international competitiveness.

VP of Engineering Joe Song[/caption]

VP of Engineering Joe Song[/caption]