The Sol SOURCE is a monthly journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains energy statistics from current real-life renewables projects, trends, and observations gained through monthly interviews with our team, and it incorporates news from a variety of industry resources.

Below, we have included excerpts from the September 2017 edition. To receive future Journals, please subscribe or email pr@solsystems.com.

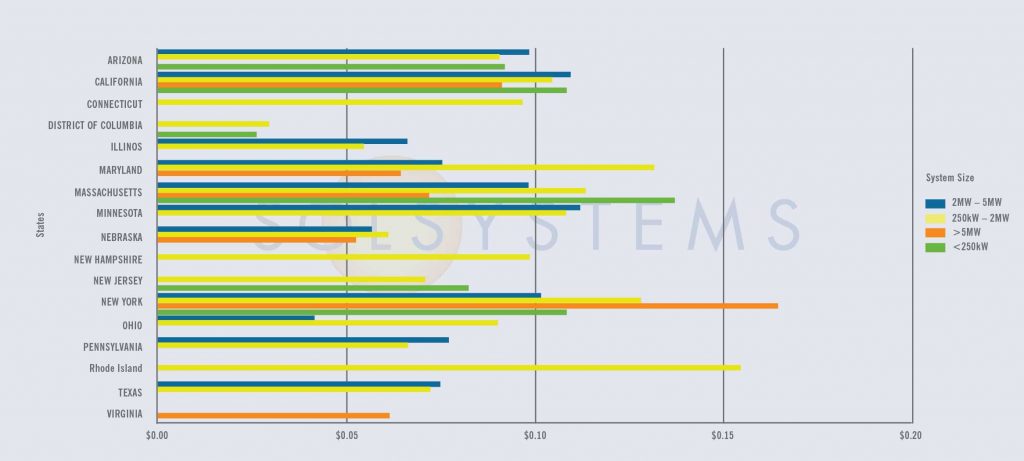

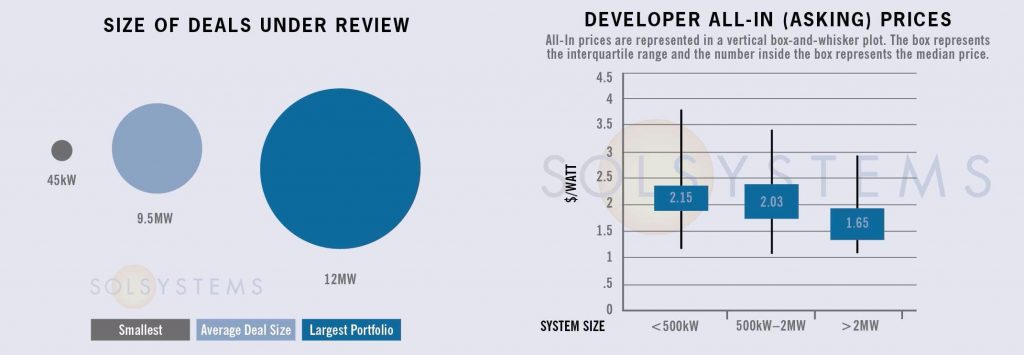

PROJECT FINANCE STATISTICS

The following statistics represent some high-quality solar projects and portfolios that we are actively reviewing for investment.

Have a solar project in need of financing? Our team can provide a pricing quote for you here.

California – After project attrition from past rounds led to unbuilt megawatts, the Los Angeles Department of Water & Power (LAWDP) feed-in tariff has reopened, roaring and ready to reclaim those lost MW. After opening the 65MW “re-offer” at the end of June, the program is now half full (or half empty, depending on your disposition). Solar projects under LADWP’s new pricing structure are on the market seeking financing, though development has been largely concentrated among a few local players.

In other California news, the legislative session ended without passage of the 100% renewables bill; it will have to be carried into next year. Meanwhile, the California Solar Energy Industries Association (CALSEIA) remains engaged in a number of rate design challenges, many of which have created a challenging environment for commercial and industrial (C&I) solar development in solar’s #1 market, especially in the southern part of the state.

Developers interested in financing for California solar projects can reach out to Anna Noucas (anna.noucas@solsystems.com), our West Coast Origination Lead based in Southern California. We’d be happy to help.

Massachusetts – Implementation of SMART, the successor program to the enormously successful SREC I and SREC II programs, continues to chug along. On August 25, 2017, the ever-industrious Massachusetts Department of Energy Resources (DOER) filed SMART regulations with the Secretary of the Commonwealth’s office, and tariff filings were made at the Department of Public Utilities (DPU) shortly thereafter.

The initial competitive procurement under SMART will take place at the end of October and set the pricing for the initial block and rest of the program. We anticipate that many developers will attempt to convert unrealized SREC II sites into standalone greenfield projects, despite the fact that land use requirements under SMART are much more onerous than in previous incentive programs. Will these projects proceed, or are developers missing the fine print in the new regulations? Time will tell.

New Jersey – With few exceptions, solar renewable energy certificate (SREC) markets are not doing so hot these days. Spot market pricing in Maryland, Delaware, Pennsylvania, and Ohio have more or less collided, while New Jersey, and especially D.C., have remained relatively strong and stable. Now that the International Trade Commission (ITC) has found injury on the 201 petition, strong state-level legislation – like we see in D.C. – will be increasingly important if tariffs are adopted.

In New Jersey, pending legislation – a substitute bill for last session’s “pull forward” bill, is now pending in the legislature. While the legislature in New Jersey is very pro-solar (don’t forget that the Senate passed an 80 percent RPS bill not too long ago), the bigger question will be whether Governor Christie will sign such legislation. Even if Christie does not, 2017 is an election year for New Jersey, which is largely expected to see Phil Murphy (D) take over the Governor’s seat. If signed into law, New Jersey could become one of the bright spots in a post-201 world.

SOLAR CHATTER

- Earlier this month, New York regulators approved implementation plans for the complex Value of Distributed Energy Resources (VDER) docket. Yet, commercial and industrial solar developers are still asking how in the world they’ll be able to get any projects done in the state; and residential is still grandfathered until 2020 under net metering. While well-intentioned, the complex and highly publicized REV proceeding has created challenges in development, and the state caught national headlines after a reduction in its Solar Jobs Census numbers earlier this year. On a positive note, NYSERDA recognized a change in market conditions in Upstate New York and increased the incentive for Residential Block 8. Is this a precedent, and if so, could we see future changes to the flawed C&I market segment?

- The 201 case is presenting a challenge for folks in need for panels, and the International Trade Commission (ITC) injury finding on September 22 will only compound this. Once someone has a line on panels, then the contracting begins. While injury has been found, the remedy is still unknown, and no party is willing to take on the tariff risk. We have seen a variety of contractual mechanisms to address the risk, the most popular being a mutual escape hatch. In addition to thoughtful contracting, developers and investors would be wise to diligence any previously executed agreements, paying particular attention to the force majeure and change in law provisions in the context of the 201 decision. Finally, it is important to remember that the petitioners in 201 are seeking not only tariffs, but potentially other remedies (such as a price floor and a quota). It may be unclear what effect a quota that then drives up the market price for panels would mean in the context of a force majeure provision. The remedy hearing will take place on October 3, and the ITC must present findings to President Trump by November 22.

- Utilities continue to try new ways to retain and attract large customers, many of which are increasing their renewable energy commitments. Notably, AEP made news after filing with the Public Utilities Commission of Ohio (PUCO) to provide Amazon Web Services with discounted energy rates. The filing would give Amazon discounts on various charges that are "non-bypassable," and the discounts are said to scale based on the number of data centers Amazon opens in its territory. Amazon Web Services has a goal to power 50% of its data centers by renewable energy by the end of 2017. While Ohio has been a lackluster state for renewable energy development due to a modest renewable portfolio standard [that was put on pause in 2015 and 2016] and a prohibitive wind setback, much of the promise for renewable energy, including a 900MW settlement agreement, lies with the PUCO.

- Here’s a heated debate you do not read about too often: termination values. Termination values in a PPA are essentially liquidated damages for offtaker default. In our experience, it is very rare that all parties initially agree on termination values. We are finding that offtakers are increasingly demanding lower termination values and asking for investors to articulate exactly how investors are arriving at their values. The era of padding these figures may be over.

- Interconnection constraints at existing feeders often require project downsizes or long fiber runs with a direct transfer trip, which is expensive. A solution at the inverter level that limits exports to what utility approves to backfeed could be crucial. While the technology exists, utilities are not recognizing it as a legitimate solution to restrict or limit backfeed. How can this change?

- Georgia Power has announced a new program for customer sited distributed generation. Projects can be submitted starting November 1. However, given property taxes and the low starting feed-in tariff (FIT) rate and high year-over-year escalation of the FiT rate, projects likely need 20+ year terms to pencil. Sol Systems has a Georgia Power-specific pro forma built and is happy to work with developers to better understand this program.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered 650MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.