California LCFS Price Trends

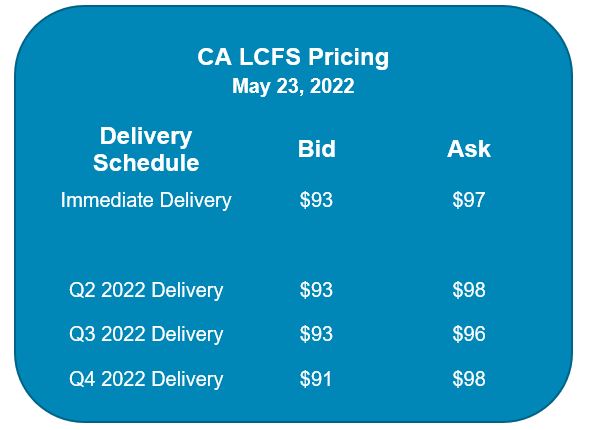

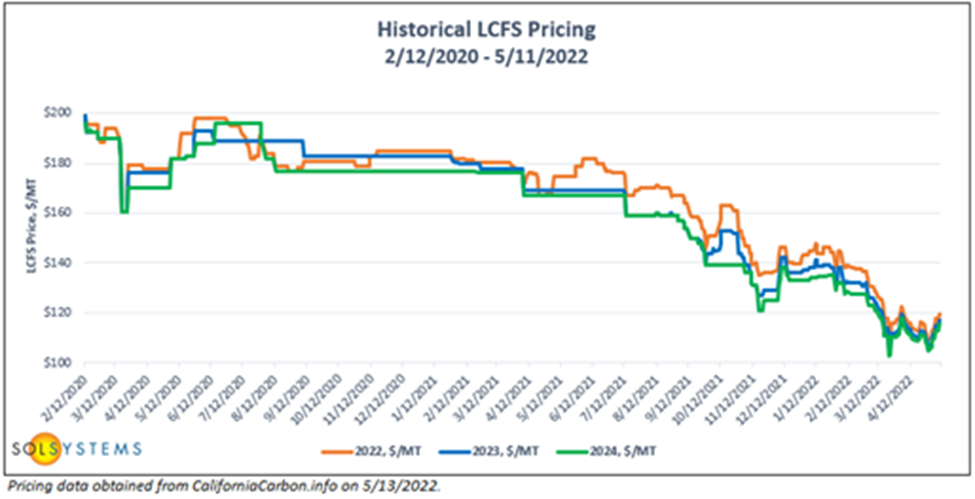

Market volatility continues in the California LCFS market despite early signs that pricing may stabilize. Since January 2022, prices fell 30-35 percent with spot prices currently trading in the $93-$98 range for immediate delivery.

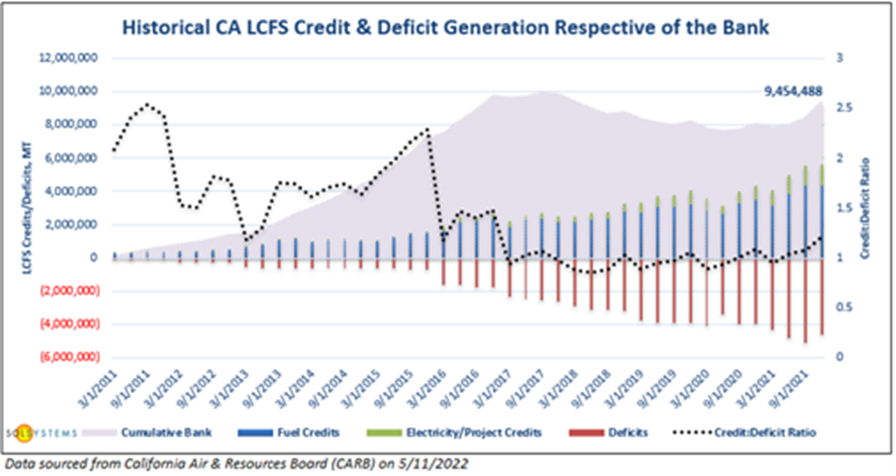

The factors driving price declines are the same as what was outlined in Sol’s January 2022 Sol Standard, particularly that supply is outpacing demand. This has led to the lowest price in LCFS credits in the past 4 years. April-May was one of the most volatile months in recent memory. Price swings during this time were seen as high as $121.50 for immediate delivery to as low as $89 bids for December 2024 delivery. These price swings were due in part by major auctions from utilities and comments from CARB regarding the future of the LCFS scoping plan. That scoping plan will not significantly change until 2024, at the earliest. In its most recent quarterly data summary released on April 29th, CARB noted that approximately 5.62 million metric tons

(“MT”) of low carbon fuel credits were generated in Q4 2021 against 4.64 million MT of deficits - a surplus of ~980,000 credits, the largest surplus in the LCFS’ program history. In contrast, only 600,000 credits were generated from Q1-Q3 2021, and only 500,000 in all of 2020. While market trackers expected a surplus, estimates were much lower, and the high spread in Q4 2021 between credits and deficits came as a surprise to stakeholders. This surprise was a large driver of immediate credit price declines to between $90 and just above $100. The surplus of credits are added to the credit bank which is slowly increasing quarter over quarter to now 9.4 million MT of credits.

Much of the supply coming into California continues to be from the renewable natural gas (“RNG”) and renewable diesel which combined accounted for 48 percent of the credits generated in Q4 2021. Many RNG and renewable diesel projects seem to be ahead of schedule and could come online earlier than anticipated which could have even more unexpected impact on credit pricing. Electricity continues to slowly increase its share of the overall market accounting for 20 percent of total credits generated in Q4 2021. The electricity segment is expected to accelerate its growth rate as current high gas prices has more consumers exploring electric vehicles (“EVs”) and lower fuel consuming alternatives. Further, on April 12, 2022, CARB released a proposal that would mandate 35 percent of new passenger vehicles sold to be powered by batteries or hydrogen by 2026, increasing to requiring 100 percent by 2035. This is a significant leap relative to the current market where EVs account for 12.4 percent of new sales according to the CARB proposal. CARB will hold a public hearing on June 9, 2022, and the Board is expected to vote on the proposal in August. If the proposal passes, California would become the second jurisdiction globally to enact such a mandate (the other being British Columbia).

Long-term strip activity within the LCFS market continues to be sparse with all activity concentrated in RNG projects.

CARB is still expected to make some market changes which may help stabilize pricing. However, any changes would likely not go into effect until 2024 – leaving another year+ of potential oversupply in the market.

Policy Tracker

Existing Markets

California

On May 10, 2022, the Air Resources Board (“CARB”) released a Draft 2022 Climate Change Scoping Plan that identified pathways to achieve carbon neutrality by 2045 or sooner. In this third edition, CARB highlighted the need to focus on the transportation sector, which accounted for over 50 percent of greenhouse gas (“GHG”) emissions and 75 percent of nitrogen oxide (“NOx”) emissions in 2019.

Some of the strategies CARB reviewed to achieve carbon neutrality in the transportation sector include:

- Achieving 100 percent zero emission vehicle ("ZEV”) sales by 2035 for light-duty and by 2045 for medium- and heavy-duty vehicles.

- Developing a rapid and robust ZEV network.

- Ensuring that the transition to ZEV technology is affordable for low-income households and meets the needs of communities and small businesses.

- Prioritizing incentive funding for heavy-duty ZEV technology deployment in regions of the state with the highest concentrations of harmful criteria and toxic air contaminant emissions.

Specifically, regarding the LCFS, CARB noted that the state would benefit from:

- Initiating a public process focused on options to increase the stringency and scope of the LCFS.

- Evaluating and proposing accelerated carbon intensity targets between now and 2030.

- Evaluating and proposing further declines in LCFS post-2030 carbon intensity targets to align with the Final 2022 Scoping Plan.

- Considering integrating opt-in sectors into the program.

- Providing capacity credits for hydrogen and electricity for heavy-duty vehicles.

The is expected to meet in the fall to consider recommendations to include in the final plan. Any changes to the LCFS program would likely not go into effect until at least 2024.

Oregon

Oregon’s Department of Environmental Quality began hosting a series of workshops to inform potential extension of the state’s clean fuels program (“CFP”). Draft changes to the CFP are expected to be released for public comment later this summer with a final rulemaking by the end of the year.

Washington

The Washington Department of Ecology convened additional stakeholder meetings throughout early 2022. We expect the department to release draft rule changes to a variety of administrative elements of the Clean Fuels Standard 9CFS) this summer.

Canada

Environment and Climate Change Canada indicated that the department expects to release final regulations implementing the Clean Fuels Standard this spring with the expectation that the program will go into effect in 2023.

British Columbia

The Ministry of Energy, Mines and Low Carbon Innovation introduced legislation on May 9, 2022, that would expand the province’s LCFS program. The Low Carbon Fuels Act would expand the scope of the program to include aviation and marine fuels, require some utilities to reinvest their LCFS revenue, and enable broader participation in the LCFS market, particularly from projects that capture carbon dioxide directly from air.

Emerging Markets

Minnesota

On March 17, 2022, the Minnesota Department of Agriculture (“MDA”) and the Minnesota Department of Transportation (“MnDOT”) released a report summarizing current discussions on whether and how to implement a Clean Fuel Standard. MDA and MnDOT noted two action items: First, the agencies proposed convening a Midwest Clean Fuels Summit to identify options to collaborate with other states. Second, the agencies highlighted several areas needing further research including impact on transportation fuel prices, jobs, rural development, and environmental justice. The agencies noted they would seek funding and research opportunities to delve deeper into these areas.

New Mexico

For the second year in a row, on February 3, 2022, the New Mexico Senate passed SB 14, the Clean Fuel Standard Act, which would have required New Mexico to reduce transportation-related emissions by 20 percent by 2030 over 2018 emissions. However, the House again failed to act on the bill before adjournment. The bill is expected to be re-introduced next year, but there are significant political headwinds to overcome before we expect any low carbon fuels bill to pass the New Mexico legislature.

As states explore whether a Clean Fuel Standard is right for them, the Harvard Environmental & Energy Law Program recently published a resource for states on managing legal risks. The Guide notes that caselaw from California and Oregon provides important lessons for states considering clean fuel standards, including which design approaches might help to mitigate legal risks. In particular, the Guide notes the importance of treating importers the same as in-state producers, basing the standards on science, and clearly stating the environmental purposes of the program.

Federal Update

A Wild Spring for Ethanol

After a winter of mixed news for the ethanol industry, this spring continues to be a wild ride.

With no additional states adopting Clean Fuels Standards (see Policy Tracker), the Biden Administration granted year-round E15, a long-time desire of the ethanol industry –. “E15” refers to a blend of unleaded gasoline and ethanol in an 85-15 ratio (i.e., 15 percent ethanol). Generally, the ethanol percentage is capped at 10 percent during the summer months when ozone formation is highest in most states given that higher percentages of ethanol contribute to additional ozone formation. At ground-level, ozone is harmful to people and agriculture. However, citing rising gasoline prices and global uncertainty, President Biden is temporarily allowing E15 to be sold all summer. The Biden Administration expects gasoline price reduction of about $0.10/gallon.

In addition, the U.S. Environmental Protection Agency (“EPA”) denied all 36 court-remanded petitions from small refiners seeking exemptions from biofuel blending requirements under the Renewable Fuel Standard (“RFS”) for the 2018 compliance year. This action was welcomed by biofuel supporters but angered small refiners expecting to receive exemptions. In addition, EPA is soon expected to propose a rule to establish an alternative Renewable Identification Number (“RIN”) retirement schedule for small refineries.

Following, in establishing the RFS, Congress set the annual renewable fuels targets through 2022 but gave EPA authority to adjust the volumes as it deems necessary, which it has historically done. Earlier this year, EPA finalized extensions of the RFS compliance deadline for the 2019 compliance year for small refineries. EPA also extended the RFS compliance deadline for the 2020, 2021, and 2022 compliance years for all obligated parties. This in particular was over the strenuous objections of the biofuel industry. Finally, EPA also established a process by which future compliance deadlines are determined. EPA anticipates this will ensure that obligated parties are able to comply more efficiently with their RFS obligations by ensuring that each year’s compliance deadline falls after the standards for the subsequent compliance year are known. EPA expects this will avoid having to repeatedly extend compliance deadlines for obligated parties if promulgation of the subsequent year’s standards is delayed, although next year’s shift to EPA (rather than Congress) setting the volumes should allow the Agency to set attainable volumes, hopefully reducing the need for annual adjustments.

While we see increasing interest in decarbonizing transportation, the RFS has remained contentious and most attention, including at the state level and through the Infrastructure Investment and Jobs Act (IIJA or Bipartisan Infrastructure Law), has pivoted to direct electrification of as much of the sector as possible. Particularly as global tensions and food shortages increase, we expect the future of the RFS to remain unsettled.