The Sol SOURCE is a monthly journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains energy statistics from current real-life renewables projects, trends, and observations gained through monthly interviews with our team, and it incorporates news from a variety of industry resources.

Below, we have included excerpts from the August 2017 edition. To receive future Journals, please subscribe or email pr@solsystems.com.

PROJECT FINANCE STATISTICS

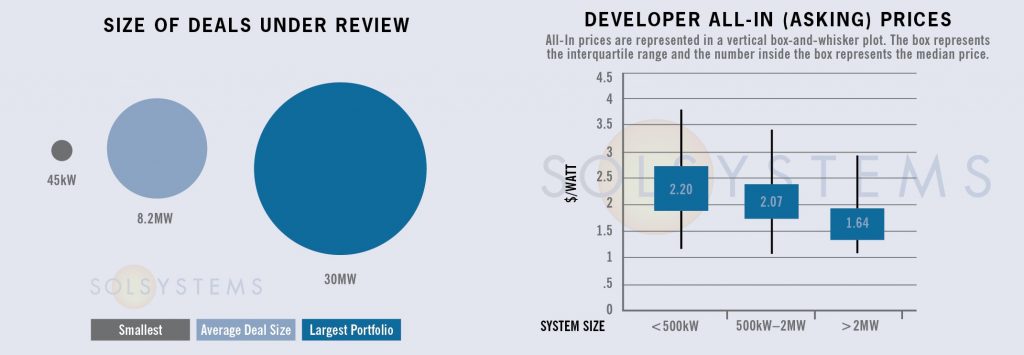

The following statistics represent some high-quality solar projects and portfolios that we are actively reviewing for investment.

Have a solar project in need of financing? Our team can provide a pricing quote for you here.

STATE MARKETS

Connecticut – It has been a long, long time in the making, and at long last, the Connecticut Department of Energy and Environmental Protection (DEEP) released a draft of its Comprehensive Energy Strategy (CES) at the end of July. The solar community has patiently awaited the draft of the CES, which many hoped would provide a longer-term vision for Connecticut’s clean energy future after a one-year extension to the ZREC and LREC solar programs was passed this year.

In the draft CES, DEEP recommends extending the Class 1 standard within the RPS from 20 percent by 2020 to 30% by 2030. While this is positive, to put it in context, legislation to increase the RPS to 50 percent by 2030 was put forth in the legislature this session, but ultimately shelved.

To increase the development of in-state renewable energy, DEEP has advocated for incentivizing renewable projects with CT. It recommends that 25 percent of the 1 percent annual RPS increase (.25 percent) after 2020 be allocated to the purchase of energy and RECs from in-state behind the meter projects. For reference, in 2014, 76 percent of Connecticut’s Class I RPS requirements were met with biomass and landfill gas.

DEEP also recommends taking a hard look at net metering as the cost of solar has declined (and will continue to decline). Their current analysis appears to highly inflate these costs (i.e. assuming commercial customers are getting a full $0.17/kWh for net metering credits when it is only $0.10-0.12/kWh).

Could the implementation of the CES help Connecticut, which has been the 18th largest solar market in the country, jump to the top of the charts? It’s too early to tell, and public engagement will be key. Comments on the CES are due September 25.

Illinois – The cat is out of the bag in Illinois, and all eyes are on the Land of Lincoln, which will be the breakout solar market of 2018 after the passage of the Future Energy Jobs Act (FEJA) in late 2016. Customers are also beginning to take notice of the emerging solar market in their state, though most of the solar programs will not go into effect until mid-2018. So what does the future look like?

While implementation of FEJA is ongoing, there are a few near-term opportunities for solar deployment. First, bids for the fall distributed generation (DG) procurement, the incumbent solar program in the state that awards 5-year REC contracts to winning bidders, are due on September 18. However, only 3MW remain for commercial systems up to 2MW after the spring procurement earlier this year; another 3MW is available for residential projects. Winning bidders will be announced on October 19.

While the DG procurement falls under the old Illinois solar regime, the first program to kickoff under FEJA is the utility-scale procurement for 15-year REC contracts. Proposals for utility-scale projects >2MW were due on August 7. Winning bidders will be announced on September 7.

After this fall, there will be no new opportunities for projects under 2MW in size until the release of the Adjustable Block Program (likely mid-2018) and the $250/kW distributed generation rebate. The Adjustable Block Program (ABP) will create an estimated 1GW of DG opportunities by 2025, so developers that miss out on the fall DG REC procurement will have their shot again next year under the ABP, which is not competitively bid.

More insight into all solar program details will be available in the Illinois Power Agency’s draft Long-Term Renewable Resources Procurement Plan, set for release in late September.

Illinois is about to get rockin’ and rollin’. Are you ready?

Massachusetts – In mid-August, the Massachusetts Department of Energy Resources (DOER) released recommendations for SMART. The initial draft of SMART left solar advocates with several concerns. For example, development on agricultural land was mostly barred under SMART due to very, very extreme requirements that would make greenfield development cost prohibitive. One requirement said that all fixed tilt projects needed to be 6 feet of the ground and tracking systems needed to be at least 10 feet off the ground, creating carport-like structures on ag land so that….cows could walk under them and cornstalks could grow? Good idea in theory, but wholly impractical from a development perspective.

Another concern about the first draft of SMART dealt with the on-bill crediting mechanism. This mechanism was originally proposed as a workaround to the net metering cap, which must be lifted by the legislature.

Among several changes to land use considerations, other notable differences in this version include:

- Elimination of adder caps. In other words, the additional compensation for projects that meet the Commonwealth’s policy goals (rooftops, carports, low income solar, community solar, etc.) are no longer capped at 320MW. Rather, there will be “blocks” for the adders (first block is 80MW) and decrease in value by 4 percent between each adder block.

- Established a maximum 35% set aside for residential solar (<25kW) for each capacity block.

- Adjusts timing for initial competitive procurement. It is now expected to take place at the end of October. This event will be critical and define the first block – and therefore the entire progam’s - compensation rate.

- Increase in ceiling price for competitive procurement from $0.15/kWh to $0.17/kWh. This means that the compensation level for SMART may begin at a higher level before stepping down by a fixed percentage as megawatt thresholds are met.

The certainty brought by the SMART recommendations arrived just in time. SREC II pipeline is reaching its tail end on the origination side for projects to meet mechanical completion deadlines set forth in the SREC II extension filed this spring. As we approach late Q3, projects that have hovered between SREC II and SMART have put developers into a precarious position. (Got a project on the fence between SREC II and SMART? Check out our blog for a refresher on important deadlines for SREC II.)

Final regulations are expected to be published by August 25; the official on-bill crediting and SMART tariffs, which lie in the purview of the Department of Public Utilities, not the DOER, are expected to be filed shortly thereafter. Like Illinois, we are expecting a summer 2018 launch for SMART.

Now that SMART is close to final, the industry has its eyes on a net metering cap lift. Legislation will be heard in October.

SOLAR CHATTER

- Kudos to our hometown of D.C. for launching Solar Works, its new program to install solar for low income residents; solar is installed by residents who are trained to be solar installers under the program. D.C. continues to be one of the most progressive solar cities in the nation, and passed a 50% RPS in the summer of 2016.

- Savings vs. risk? That’s a question some commercial customers are weighing, and we are seeing some requesting shorter PPA contract terms. If EPC costs continue to fall (barring tariffs), could we see more customers opt for shorter contract terms rather than longer term savings in a 15-20 year contract?

- The Maryland solar market continues its nose dive, with SRECs hovering at $6.50/REC. Unfortunately, there is no relief in sight, unless advocates can capitalize on the federal anti-climate sentiment to push for a more aggressive RPS. With other East Coast clean energy leaders such as Rhode Island, New York, and D.C. pushing for a 40-50% RPS, can Maryland be the next in the 2018 legislative session? We sure hope so, though SREC market recovery would still take time.

- We love us some Rhode Island, and you should too! The Ocean State continues to lead in clean deployment. After Governor Raimondo announced a 1GW clean energy by 2020 goal earlier this year, the state passed a suite of renewable energy legislation, and now has begun implementation on efforts to streamline solar permitting and develop the 2018 Renewable Energy Growth program. Meanwhile, bids for second enrollment of the 2017 Renewable Energy Growth program closed at the end of July. The majority of 2017's allocation in the commercial scale and large scale solar category was taken up in the first enrollment, leaving the question open as to whether there will even be a third open enrollment.

- Rumor has it that the commercial and industrial (C&I) sector of the solar market will see more consolidation over the coming months. This sector of the market has always performed sluggishly compared to its residential and utility-scale peers, largely due to high transaction costs associated with relatively smaller individual, one-off projects (as compared to large residential portfolios or multi-megawatt utility-scale solar projects). Structural capacity is another limiting factor for rooftop C&I. Some roofs are old and unfit for solar, and for new development, real estate developers are not typically in the business of spending more money to ensure that a rooftop will be “solar ready.” Will C&I truly scale until this challenge is resolved? Perhaps, if a tax credit or some other mechanism could incentivize real estate developers to spend more upfront on roof structural capacity preemptively to support the possibility of solar. It could have a 10 or 20-year clawback if no solar gets installed. Same could be done for building retrofits. Food for thought…

- The Suniva trade case continues to create uncertainty in the market. While projects currently under development are already taking the heat, luckily, some regulators are very in tune to this issue. Notably, implementation of various state renewable energy programs are creating tariff and no tariff pricing scenarios. If tariffs are enacted, this could soften the development slow-down in the few states that are being the most proactive.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 600MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.