2017 has certainly been an interesting year for solar investments. While early policy reform uncertainty had some investors staying away, many are back at the table and wondering, where are the assets, and how can I invest?

At the beginning of the year, the prospect of tax reform under the new administration forced many tax equity investors to the sidelines. However, the market soon realized that after early setbacks in President Trump’s legislative agenda, the likelihood of tax reform occurring in 2017 quickly shrunk to zero. This general consensus on tax reform, and need to offset “business as usual” 2017 tax appetite, brought many investors back to the table midway through the year; new investors even entered the market.

While six months ago, the solar industry would have been right to gripe that insufficient capital was available to meet project demand, now we are seeing the inverse. There are currently not enough investment-grade, large projects to fill the demand of tax equity investors for third-party structured finance deals.

Where are the Projects?

Several factors contributed to this slowdown in projects available for tax equity investments.

Distributed utility projects – those that have long-term power purchase contracts with investment-grade utilities, but typically fall below 20MW in size – provide cookie-cutter development opportunities and scalable, but still bankable, portfolios for investors. However, several major state markets like North Carolina are facing challenges in utility interconnection policy, PURPA implementation, or both (it should also be noted that in the case of North Carolina, this could change shortly with renewable energy legislation recently signed by Governor Cooper). Utility queues are filling up in many established markets like Massachusetts, and Maryland, and even some relatively lower penetration states like Oregon, South Carolina, and Virginia are experiencing lags in scheduled interconnection dates. Projects struggling to get utility approval or commitments from utilities’ construction crews in large scale solar creates a slow and clunky development and financing process, and projects that would have otherwise been completed in 2017 are slipping into next year.

According to GTM’s Q2 2017 U.S. Solar Market Insight report, 2017 was the first year that national installations fell on both a quarter-over-quarter and a year-over-year basis. In California, an established market, and Oregon, a breakout market over the last two or so years, several hundred MWs of utility scale solar will spill over into 2018 from this year. Overall, the development timeline for qualifying facilities (QFs), facilities of choice often for tax equity investors, is lengthening, even as key PURPA markets limit the capacity and term of standard PPA contracts.

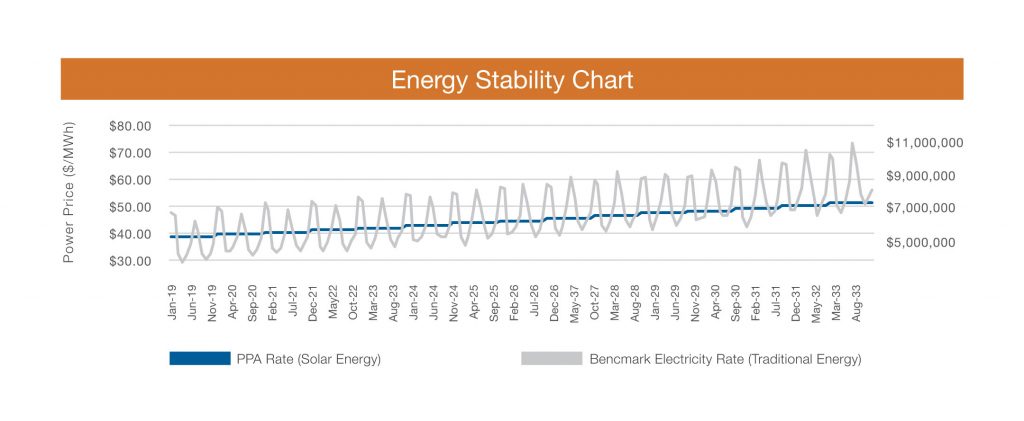

Yet despite development headwinds in 2017 for utility projects, solar’s maturation as a market is creating more competition, which means thinner margins all around. GTM reported that utility scale PPAs are now between $35/MWh and $50/MWh, and getting long-term, credit-worthy PPAs with both utility and non-utility offtakers is increasingly difficult. Competitively bid PPAs and razor-thin EPC and development margins result in pressure to find the most competitive financing available, even as tax equity investors continue to seek higher returns.

The Emergence of New Tax Equity Investors

Tax-advantaged buyers entering the market also contribute to a paucity of projects for 3rd party, structured finance deals. These investors are hungry for solar assets, but may not need the tax equity piece. For example, Florida Power & Light recently announced 250MW of utility-scale solar development, and will be rate-basing the investment instead of financing with tax equity and debt. Some southeastern investor owned utilities (IOUs) follow this trend, like Dominion Virginia and Georgia Power, who alongside FPL and five other utilities have outlined a combined 10.8 GWdc of additional utility solar planned according to GTM’s Solar Market Insight Report.

Tax Equity & the Trade Case

Finally, we would be remiss if we did not mention the Suniva and SolarWorld Section 201 filing. Rising module prices, if developers can even find modules to buy, has compounded the stresses in the market detailed above. In response, developer/sponsors looking to hedge against market uncertainty will either offload assets to entities that can finance in-house (and have the balance sheet to lock up modules early), or simply not build assets until a determination is made by the International Trade Commission, further reducing the supply of assets on the market.

Where’s the Market?

Even with setbacks, and much of the low-hanging fruit being picked off, for the determined investor wanting to make solar a part of their tax strategy there is a path to move forward.

“More tax equity players entering the market is a good thing for the solar industry,” according to Jessie Robbins, Director of Structured Finance. “For tax equity investors already in the space or thinking about entering, it’s important to identify a strategy and an approach to investing in a year where capital seems to be more plentiful than projects.”

Investors should focus on understanding what value they provide to developers in the market – attractive pricing? Certainty of execution? Flexible structure? While offering strong economics to sponsors will always be fundamentally important, sponsors also prioritize other elements of a deal that can have a material impact on their returns and strategy; for instance, accommodating project-level debt, offering various flip options, or executing quickly. (Shameless plug: Sol Systems recently closed a transaction in under four weeks to accommodate an incredibly tight utility interconnection schedule.)

Conclusion

With a quarter still to go, 2017 has been an interesting year for developers and investors alike, to say the least. For those investors already at the table, there is potential for 2017 to be a unicorn year for transactions that could benefit from a boost in returns if tax reform passes in 2018. Even for investors contemplating 2018 investments, Sol Systems sees numerous options to structure around risk of a tax rate change. Sol Systems is poised to help make those investments happen whether you are a potential investor or a developer looking for an investment.

For any tax equity related questions, please reach out to:

Jessie Robbins

Director, Structured Finance

202-588-6278

jessica.robbins@solsystems.com

This is an excerpt from the August 2017 edition of The SOL SOURCE, a monthly electronic newsletter analyzing the latest trends in renewable energy based on our unique position in the solar financing space. To view the full Journal, please subscribe or e-mail pr@solsystems.com.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 600MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.