Any day now, the Department of Energy should be releasing the results of a study initiated by Secretary Rick Perry that examines the security and reliability of the US electrical grid with respect to the retirement of baseload power generation plants. In July, an Interim Draft Report of the study was released, which included in its findings:

Some baseload plant retirements have been premature relative to their design life and operational efficiency. Costly environmental regulations and subsidized renewable generation have exacerbated and accelerated baseload power plant retirements. However, those factors have played minor roles compared to the long-standing drop in electricity demand relative to previous expectations and years of low electric prices driven by high natural gas availability.

Given this conclusion (which may or may not be included in the report at the time of submission), it is time to look at the real culprit that is putting coal and nuclear out of commission: natural gas.

The Game of Natural Gas Limbo

With the achieved commercialization of hydraulic fracturing (fracking) techniques starting in 2007, natural gas prices fell precipitously from nearly $13/mmBtu in June 2008 to $3/mmBtu in September 2009 and have stayed low since (EIA 2017).

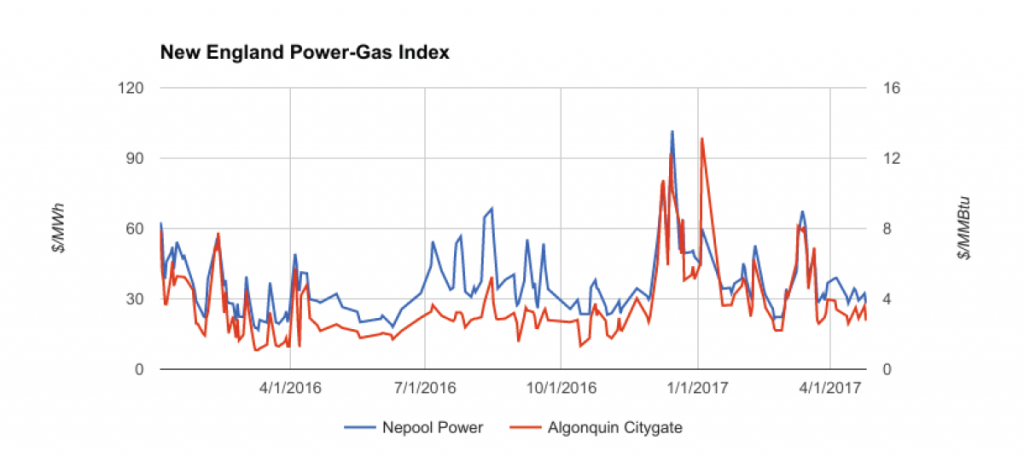

As a result, power prices, which correlate strongly with natural gas prices (see graph below), have also fallen and stayed low in recent years. This is great news for electricity consumers, but has created difficult conditions for power generators —both traditional, baseload sources like coal and nuclear as well as new, renewable generation like wind and solar. In fact, one of the major victims of cheap natural gas flooding the wholesale power markets is the nuclear industry, which just suffered a major setback in South Carolina.

The situation in South Carolina is not unique. Given the suppression of power prices caused largely from gas, many utilities across the country are requesting zero emission credits (ZECs) from state regulators in order to keep their nuclear plants running. As we have covered previously, so far, Illinois and New York have been successful, and we are seeing more utilities attempting to tag ZEC support onto renewable energy legislation.

The Wholesale Market & Renewable Energy

Renewable resources like utility-scale solar that compete with other power sources on the wholesale market often depend on upward trends in power prices to make their fixed-price, long-term power purchase agreements (PPA) financeable. Although massive reductions in the construction costs of solar over the past decade have driven US PPA prices down as much as $100/MWh in the past 5 years, consumers are hesitant to fix their power price in a near-term, gas-rich environment where wholesale rates continue to drop. But will prices continue to drop?

[caption id="attachment_4988" align="aligncenter" width="900"] Source: U.S. Department of Energy[/caption]

Source: U.S. Department of Energy[/caption]

Will Natural Gas Prices Continue to Fall? A Look Forward

On August 3, the Senate took a step that could have major ramifications for wholesale power prices and the US electricity market more broadly by voting to approve new FERC commissioners, Robert Powelson and Acting Chairman Neil Chatterjee. These two additions are critical, as it brings the five-seat commission to three members, the quorum required for voting on major issues like issuing certificates for gas infrastructure projects.

The Interstate Natural Gas Association of America estimates about $14 billion in private capital for energy infrastructure projects has been held in limbo by the lack of a FERC quorum. This included approval for a number of liquefied natural gas (LNG) export terminal projects such as Corpus Christi, Elba Island, Cameron, Freeport, and Cove Point, which are poised to bring the total US LNG export capacity to more than 9 Bcf/d by the end of 2019, almost five times what the U.S. can produce now. Given the support from the White House for LNG exports as a way to reduce trade deficits, create domestic jobs, and even reduce Russian influence in Eastern Europe, the momentum to push these projects through appears powerful.

Could these seemingly-at-odds major natural gas infrastructure projects actually be a catalyst for renewable energy competitiveness in the US? It all depends on how you interpret the potential impact of LNG exports on US natural gas prices.

LNG: The Long-Term Implications

With US electricity demand becoming stagnant, natural gas producers have looked for other markets like Mexico, where electricity demand has more than doubled in the last 20 years and continues to grow at more than 4% annually (IEA 2016). With a massive oversupply depressing domestic gas prices, the US has already begun delivering LNG shipments from a few export terminals in the Gulf Coast. According to the IEA, the US is on track to become the world’s second largest LNG exporter by 2022.

For some countries, the prospect of receiving US LNG exports may be as political as it is economical. The United Arab Emirates, which once received its natural gas from Qatar, the world’s largest LNG exporter, is now receiving US LNG after a group of Arab countries cut diplomatic ties with Qatar in early June. As mentioned earlier, it has also been suggested that Poland and other Eastern European countries are using the prospect of US LNG as a negotiating piece for lower prices from Russia. Regardless of the intent for buying US LNG, the likely result is an increase in domestic US natural gas prices, as the cheapest supply will be shipped overseas to markets with higher prices. Although an increase in demand does not necessarily imply an increase in price, recent downward trends in natural gas reserve inventories suggest there will be less supply-side price depression.

US LNG Gross exports:

2016: 0.5 Bcf/d

2017: 1.9 Bcf/d

2018 (expected): 2.8 Bcf/d

2022 (forecasted in IEA 2017 global gas report):

- Australia- 11.5 Bcf/d

- US- 10.4 Bcf/d

- Qatar- 10.2 Bcf/d

Many have already begun to factor US LNG exports into their long-term forecasts for natural gas and wholesale electricity prices. After continuing to revise power price forecasts down for 11 out of the last 12 quarterly 20-year price forecasts since 2014, SNL Energy (a subsidiary of S&P Global Market Intelligence) has finally shown an average percent increase in power price forecasts across 28 US power hubs of about 4% annually. SNL’s Q2 2017 Forecast Guidance concluded that “with comparable electricity demand to the second quarter of 2016, higher natural gas prices emerged as the single strongest factor influencing power prices..."

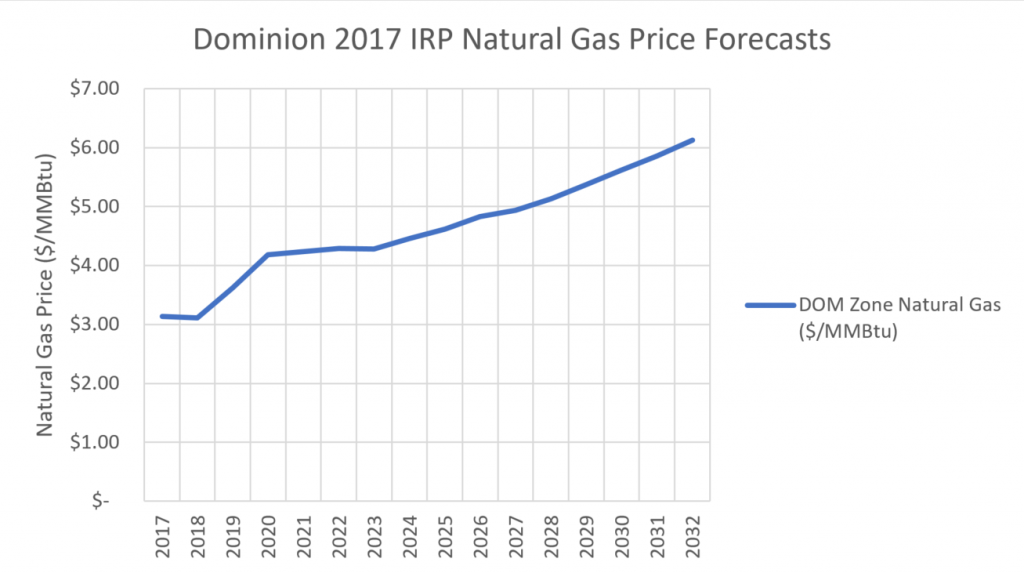

Using a more localized example, in their most recent Integrated Resource Plan, Virginia-based utility Dominion Energy forecasted a more than 30% rise in natural gas prices over the next few years, around the same time that US LNG export capacity is supposed to triple.

Dominion’s forecast should carry some weight and legitimacy given their insider’s track into the supply and demand forces of the natural gas market. With construction on their Cove Point LNG export terminal in Maryland expected to be completed by the end of the year, Dominion looks to become the second US exporter of LNG produced from shale gas.

Dominion also notes that “the 2017 Plan includes a considerable amount of solar resources…due to their optimal economics, low or zero emission characteristics, and the fact that the installed cost of solar PV generation has decreased by approximately 24% between the filing of the 2016 Plan and the 2017 Plan.” This data point corroborates a growing trend: as solar prices continue to fall and natural gas prices ultimately rise, solar will become an increasingly attractive, competitive option.

Conclusion

There is no denying that natural gas, and consequently electricity prices, are low, but how long can they keep up this game of price limbo? Time will tell, but major corporations (and even utilities) are already hedging their bets against possible volatile future pricing with solar.

For more information about how a solar PPA can protect you from future natural gas price risk, reach out to Colin Murchie at colin.murchie@solystems.com or call 202-349-7645.

This is an excerpt from the August 2017 edition of The SOL SOURCE, a monthly electronic newsletter analyzing the latest trends in renewable energy based on our unique position in the solar financing space. To view the full Journal, please subscribe or e-mail pr@solsystems.com.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 600MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.