This is an excerpt from the September 2017 edition of The SOL SOURCE, a monthly electronic newsletter analyzing the latest trends in renewable energy based on our unique position in the solar financing space. To receive future editions of the journal, please subscribe.

As the solar industry continues to grow and become cost-competitive with traditional fuel sources, how states think about incentivizing the technology has also evolved. Ten years ago, renewable portfolio standards accompanied by solar renewable energy credit (SREC) markets were a primary mechanism to grow a nascent solar industry, at least on the East Coast. In recent years, we’ve seen SREC markets remain in states with existing programs, but new domestic programs have shifted from this market-based SREC structure to other models, such as fixed-price or competitively-bid, feed-in tariffs (FiT), centralized REC procurements, and auction-like programs. Will this trend continue, and if so, what are the pros and cons of moving away from a market-based incentive model?

Who’s Switched Sides?

The most topical of East Coast markets switching sides is Massachusetts’ forthcoming switch from its SREC II program to the Solar Massachusetts Renewable Target (SMART) Program. SMART will transition the Commonwealth’s solar incentives to long-term, fixed-rate contracts that operate more like a FiT rather than relying on SRECs traded on the open market. Massachusetts follows the footsteps of its southwestern neighbor Rhode Island’s RE Growth Program which offers a competitively-bid FiT for projects.

Unlike Rhode Island, however, Massachusetts will not be fully competitively bid. Rather an auction mechanism will set the initial price for the program. After that, each “block” within the program will step-down in price and volume once all capacity in a given block is filled. Declining block incentives were made popular with the enormously successful California Solar Initiative (CSI), followed by New York’s Megawatt Block, and soon, Illinois’s new Adjustable Block Incentive for distributed generation, which will go live next summer.

Other states have kept SRECs, but embraced competitive bids for long-term SREC contracts rather than trading setting SREC pricing. States that have gone this route include Delaware, Illinois, and Connecticut with its LREC/ZREC program.

The Market-Based Strongholds

Not all states have followed this path though, and fully privately-settled SREC markets have remained in Maryland, Pennsylvania, Ohio, New Jersey, and the District of Columbia. In these states SREC markets created or are still creating meaningful revenue generation for solar facilities bringing investors and developers to the table. Some states have stayed stronger than others, however, and in Maryland, Pennsylvania, and Ohio SREC pricing has waned, changing project economics. In Maryland, we’ve still seen a strong build rate, particularly in the residential sector. However, the state’s potential C&I sector, with more demand-based rates, may see less growth and need better market incentives.

Some states have taken measures recently to improve their programs and try to further accelerate deployment and expand growth for system types which require higher prices. Maryland and D.C. both passed legislation within this past year and a half to increase their renewable portfolio standards, and in light of a shifting federal landscape, Maryland seems likely to introduce a 50 percent renewable portfolio standard (RPS) bill next year. New Jersey also has legislation on the table this year to increase its solar carve-out.

Which Side Should the Coin Land On?

Operational Continuity

There are two sides to every coin. What side is the industry hoping the proverbial coin will land on? There are arguments to be made for and against these varying incentive structures. From an operational standpoint, both have drawbacks and advantages. For bidding into SREC procurement programs, a REC auction, or FiT, the timing on this can be complicated. The program opens, and projects are bid in and then rushed to be done by the prescribed deadline before often have to wait again. There’s also the potential that a project doesn’t win a bid. What then? This leads to lumpy development cycles.

For SREC markets, on the other hand, the registration process for incentives starts only once a project is complete. This paperwork and trading can sometimes be complicated, especially for the average homeowner. Because of this, SRECs often need a third party involved (like Sol Systems) to help navigate market fundamentals, and even complex paperwork and regulations.

Investor Pricing

In regards to pricing of the incentives, there are pros and cons as well. Competitive solicitations, as we’ve touched on before with the Connecticut ZREC Program, can force project developers to bid below a financeable threshold in order to win; in this way, these solicitations are often a race to (or below) the bottom. In theory, Massachusetts’ new SMART program aims to avoid the two key issues with competitively bid programs. The first of which is administrative price-setting issues which has led to two flavors of unsuccessful programs: the too-high “binge and crash” FiT, or the too-low “failure to launch” programs like NY MW Block C&I. The second key issue with bid programs is the large amount of pricey transactional “friction” that comes when every system, no matter how small, must submit an incentive bid.

Volatility

However, despite complexities, long-term contracting, whether it is through a REC procurement, declining block incentive, or feed-in tariff, provides long-term price certainty that investors prefer. SREC prices, on the other hand, can be volatile and are subject to fluctuating market conditions, oversupply, or sometimes, even a rumor. Just look at the Maryland market today, where prices have plunged from $100 to $6 over the last 18 month, or New Jersey, where prices went from a high of $700 in 2009 to $70 circa 2012.

Dynamic Flexibility

Despite their volatility, however, market-based SREC programs do have their benefits. SREC markets respond to overarching industry conditions and build rates. Put simply: an RPS requests a certain amount of its renewable energy requirement to come from solar via a solar carve-out. When there isn’t enough solar (i.e. DC), prices are high to encourage growth. When there is more solar than needed per the RPS, prices plummet (i.e. currently everywhere else besides D.C. and New Jersey).

Jobs

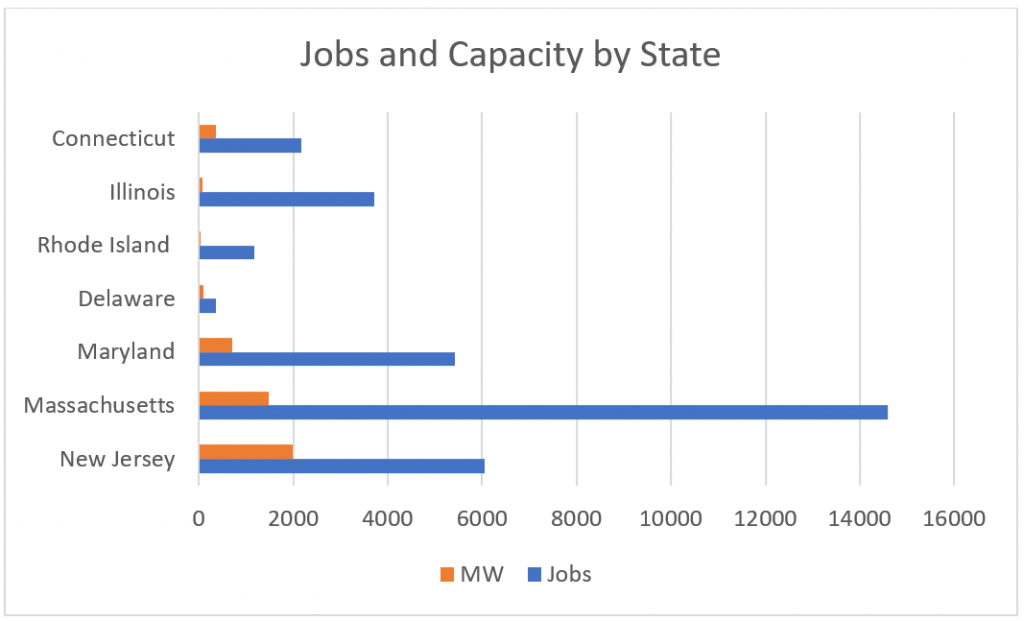

This method may keep costs low for ratepayers, and it’s true that solar incentives do not need to be as high as they used to in most markets. However, price suppression can lead to less build and layoffs fueled by lack of uncertainty in regards to future RPS increases. Look at Pennsylvania in 2011 versus today. In 2011 Pennsylvania had over 4700 solar jobs; however, in 2016 with continuously declining SREC rates came a decline in solar jobs and today the state only has around 3000. Nevertheless, SREC markets such as Massachusetts, New Jersey, and Maryland have been incredibly successful in generating both jobs and megawatts as can be seen in Figure 1 compared to other Northeastern states that didn’t start with SREC markets.

At the end of the day, different states will choose different policies to meet their clean energy goals, and there is room under the sun (pun intended) for all programs to be successful, if implemented thoughtfully.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered 650MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.