Clean energy resources like solar and wind energy are fast becoming the cheapest sources of electricity generation in the United States. Since 2009, the levelized cost of electricity dropped by 69% for onshore wind power and by 88% for solar power. The numbers and trends are more or less accepted as fact—itself a triumph in these Orwellian times. The accompanying benefits speak for themselves and have won over many former skeptics. Solar and wind are thriving in states that lean conservative, including the next five biggest state markets after California for installed solar capacity and four of the top five for installed wind capacity. The clean energy transition is well underway, riding on the twin tailwinds of necessity and value.

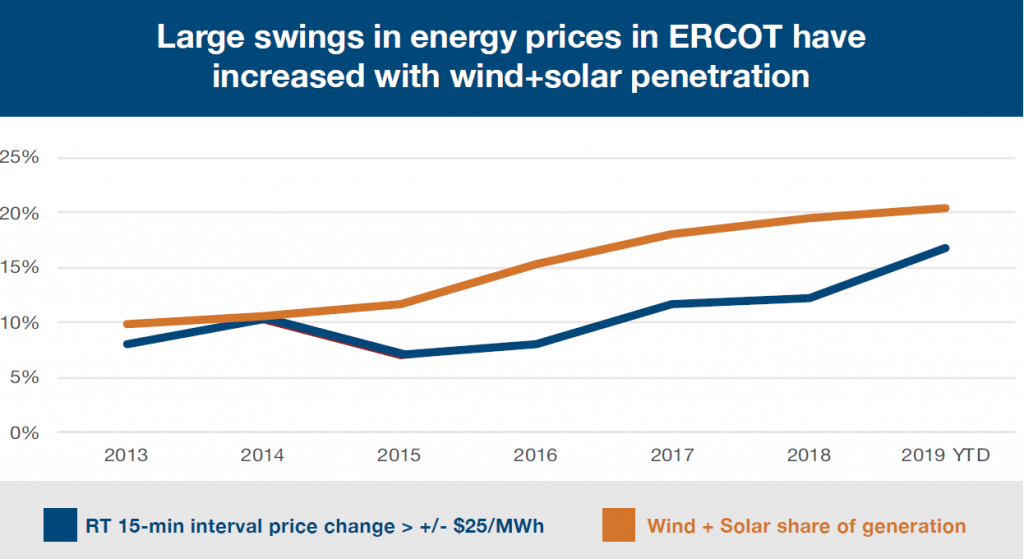

In jurisdictions with competitive wholesale electricity markets, the growing penetration of renewables poses challenges, not only to grid operators but to all market participants. The variable levels of output of wind and solar resources increase price volatility in the energy markets. This has already become a reality in ERCOT and may soon be the case elsewhere too. Solar and wind projects are also increasingly exposed to this merchant power price volatility due to shortening PPA terms and offtake structures that put some price risk on the projects.

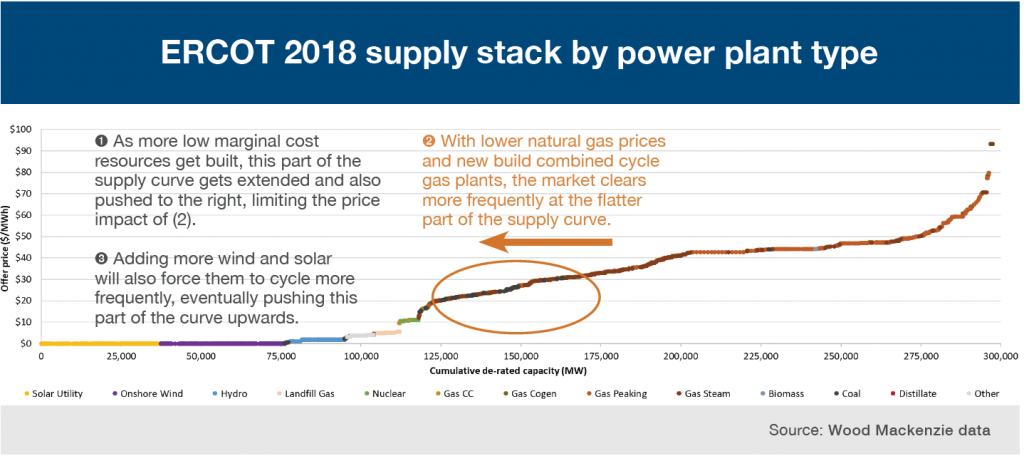

For someone unfamiliar with the mechanics of wholesale electricity markets, it may not be immediately apparent why adding greater volumes of cheaper resources, especially zero marginal cost resources like wind and solar, does not always depress power prices. The answer to the bi-directional volatility in prices lies in the operational attributes of other non-variable generators in the system.

A system with high renewables penetration is susceptible to fluctuating levels of output from wind and solar plants. Here, seasonal or day-to-day variability is perhaps less important than intra-day variability. If it is sunny and windy one day but cloudy and calm the next, it is still more predictable than a scenario where wind speeds suddenly drop off or cloud cover develops rapidly over some large solar plants. A week-long heat wave consistently pushed weekday peak prices above $1,000/MWh in ERCOT during the week of August 12, but prices truly spiked and reached the mythical $9,000/MWh cap when wind generation levels suddenly plummeted.

When faced with sudden shortfalls in generation, grid operators signal other non-variable resources to ramp up their production and make up for the lost generation from the renewable resources. Before the advent of solar and wind plants, supply-demand imbalances usually occurred when load increased or decreased rapidly. Generators that adjusted their production accordingly were called load-following generators, compared to baseload plants which churned out a steady amount of power regardless of the load profile.

However, ramping production up or down is not optimal for all conventional generators and adds more costs to their offers, thereby raising clearing prices. Furthermore, such generators face more wear and tear when they are forced to cycle more frequently than they were designed to, adding more maintenance costs over time. Further compounding this issue is that as more conventional generators retire, they are replaced by either variable renewable resources or combined cycle gas plants (which are not designed to ramp frequently), the very resources pushing them into retirement.

Owners/operators of coal plants and other older thermal generators complain about subsidized renewables driving their plants to retirement, but in truth the blame remains within the fossil fuel industry.

The efficiency of modern combined cycle gas plants, together with the shale revolution in the United States, which has drastically lowered natural gas prices, are primarily responsible for pushing market prices down and making coal, nuclear, and older thermal plants uneconomic. As those resources retire over time, and given the current trends of new generator build-out, combined cycle gas plants will form more and more of the supply curve. As the supply curve flattens as a consequence, the negative price impact from a rightward shift along the curve resulting from increased demand should get smaller. However, dynamic markets are also likely to see numerous other trends collide over the time horizon during which this effect plays out. Utilities exposed to price volatility may place greater emphasis on demand response and electrical vehicle charging programs. Generators are also continually adapting to market trends in their operations and asset management practices that help them capture incremental gains. Such market responses have the potential to mitigate volatility, but perhaps not to the extent that most market participants desire.

An obvious solution to managing the volatility caused by variable wind and solar is batteries. Indeed, large hydro plants have been tamping volatility for grid operators for some time, especially in the Pacific Northwest. These plants effectively simulate the functionality of batteries by adjusting their dams and the subsequent flow of water, which in turn generates electricity more responsively. Battery storage systems can rely on both charging and discharging modes to help ramp up or ramp down as long as there is sufficient storage capacity scattered strategically across the grid. As grid operators become more familiar and comfortable with the software controls, operational range, and capability of batteries, they can rely on batteries to smooth variable generation, regardless of whether or not they are co-located with the solar or wind project.

For flexible grid-scale storage to be operational reality, market prices must provide the incentives to invest in these resources. Although FERC’s Order No. 841 addresses opportunities for storage resources to participate in wholesale markets, grid operators must also continue to reform how market pricing is determined. The value of the flexibility provided by batteries should be reflected in market prices to ensure that price signals incentivize investments in storage, whether as a standalone or a co-located resource. Again, FERC has recognized this and directed PJM and NYISO to revise their price formation procedures to accommodate fast-start resources. Continued evolution of these procedures as the penetration of renewables increases would accelerate the deployment of wind and solar deployment in the least disruptive manner possible.

This is an excerpt from the Q3 2019 edition of The SOL SOURCE, a quarterly electronic newsletter analyzing the latest trends in renewable energy development and investment based on our unique position in the solar industry. To receive future editions of the journal, please subscribe.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008.

Over the last ten years, Sol Systems has delivered 800 MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com