Mexican lawmakers are close to dismantling the national renewable energy market by acting to pass a constitutional reform proposal that would fundamentally change the Mexican national power sector leaving renewable energy buyers and developers with nowhere to turn. The proposal would devastate the energy market in the eleventh largest economy in the world.

Despite increasing corporate and consumer demand for new Mexican renewable energy, the current administration is pushing hard to pass the constitutional proposal. In essence, the proposal would renationalize the Mexican power industry and set Mexico on a backward slope, potentially erasing decades of progress in its journey to clean energy.

Current Mexico Market

In 2014, Mexican energy reform policies, while not perfect, opened the door for private energy firms to participate in the power sector. It created a wholesale market, independent system operator (ISO), and created one of the most competitive global solar markets – largely driven by corporate and customer demand.

Yet, after the election of President Andrés Manuel López (AMLO), the 2014 energy reform policies have been re-branded as a threat to the state-run electricity utility - Comisión Federal de Electricidad (CFE). It is becoming increasingly clear that AMLO is prioritizing state-owned enterprises and their legacy fossil fuel supply over a competitive Mexican energy economy. A position strongly supported and advocated for on behalf of Mexican fossil fuel monopoly and utility giants, Pemex and CFE.

Energy dominance is part of AMLO’s “Fourth Transformation” (4T) plan focused on returning economic power to the state, and as some experts have observed “change [or threaten] the very nature of Mexican identity.”[1] As a result, anti-renewable actions continue to mount, for example Executive Actions from May 2020 solidifies AMLO’s position. Shortly after AMLO was elected, the renewable energy auctions were cancelled, and it became increasingly clear that obtaining the national level permit for new renewable energy projects would be political in nature and increasingly difficult, often not possible.

Yet, one positive area of growth in Mexico has been the Generación Distribuida (DG) segment of the market – where installations less than 500 kW could receive accelerated net metering and interconnection approval. There is very strong customer demand for DG resources given both increased corporate sustainability targets and the growing concerns over rising national electricity rates.

Nevertheless, AMLO took executive action that limited large-scale solar development in favor of state-run fossil fuel entities. Yet, the Mexican Judicial branch has consistently denied his attempts to make unilateral change calling them unconstitutional. Some view the Mexican legal system as the key source of hope for the renewable energy industry during AMLO’s 6-year term limited presidential term. This hope was somewhat bolstered when during the Mexican mid-term elections AMLO’s political party - Movimiento Regeneración Nacional (MORENA) - lost several seats, although MORENA still performed well at the state level.

The New Energy Reform

The AMLO administration proposed the current Energy Reform at the beginning of October 2021, making an unprecedented attempt to renationalize the power industry, likely crippling the country’s clean energy transition and economic growth for years to come. This is evidenced by administration’s plans to table discussions on decommissioning fuel oil burning power plants, and the intention double-down on the use of PEMEX oil for power generation. This is coming from information in the energy ministry’s 2020-2024 development plan[2]. Similarly, Mexico’s increased focus on coal to generate electricity and AMLO’s acknowledged “fascination with fossil fuels” leave little doubt as to the goals and consequences of the proposed changes.

This proposed new energy reform would impose restrictions on private participation that are even more stringent than the state of the Mexican power sector prior to the 2014 Energy Reform. The proposal would make it illegal for private companies to directly procure power or self-supply energy.[3] The actions would make Mexico’s generation mix both dirtier and less reliable, likely leading to more rolling blackouts and brownouts already causing issues as energy supply growth stalls and electricity prices continue to increase.

Deeper Dive on What the New Energy Reform means?

Source: Data from Consejo Coordinador Empresarial

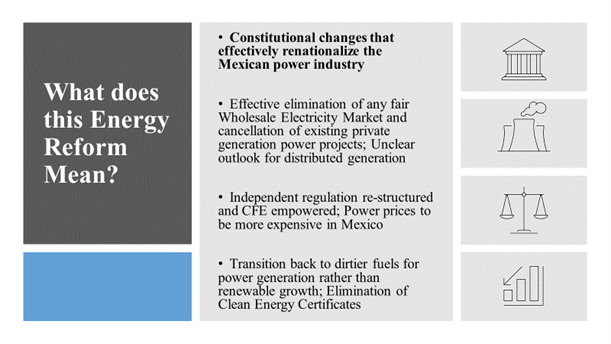

The new energy reform targets articles 25, 27, and 28 of the Mexican constitution with the goal of reinstating state monopoly in the electricity sector by substantially changing these sections. The reforms would re-vertically integrate the national utility CFE, folding in the CRE (the energy regulatory commission) and CNH (oil regulator) into SENER (the Cabinet Department for energy), and folding CENACE (the independent system operator) into CFE. Under the new reforms, the Wholesale Electricity Market (MEM) would be effectively eliminated as CFE would oversee dispatch, determine transmission /distribution tariffs, and all pending and existing permits for large scale generation would be cancelled along with agreements made by the public sector to purchase electricity.[4] The natural concern is that the new energy reform would remove most all independent regulatory checks and any semblance of a fair marketplace.

Moving forward, CFE would be constitutionality entitled to always generate at least 54 percent of Mexico’s electricity– theoretically leaving up to 46 percent for private generation, but there is no clear way or mechanism for private generation to sell electricity, and it is hard to imagine how investors and developers will have confidence to invest in new renewable projects given this uncertainty and CFE’s discretionary power over any project.

The proposal also ends the clean energy certificates (CELs) program – the Mexican equivalent of renewable energy credits (RECs) – a further blow to any type of market structure or incentive that would support Mexico’s renewable energy targets.

Generación Distribuida (DG)

It is still unclear how distributed generation (DG) would be affected by this proposal. The text o the energy reform does not explicitly target DG, but it does propose cancelling all private generation contracts. Given the Administration’s primary focus on eliminating the larger self-supply private generation contracts (as opposed to rooftop distributed generation) combined with previous support from CFE for DG, it could be interpreted to mean that 500 kW and smaller systems will not be substantially impacted. However, the language canceling private generation contracts potentially creates uncertainty around DG too - which will put many DG investments in limbo and make it more difficult to confidently develop DG projects. Even if DG is initially unaffected, significant growth could lead to future action from the administration.

Rooftop Solar in Mexico eliminates approximately 1.3M tonnes of CO2 annually according to SENER[5] and has the capacity to increase given strong customer demand and a well-established industry. This too is threatened by this Energy Reform.

Mexican Legislative Outlook

It is hard to understate how drastic the new energy reform proposes are and how many projects, companies, and individuals the reforms would negatively impact. While on its face, the legislation lacks the two-thirds majority support it needs to pass, AMLO has increased pressure on the Partido Revolucionario Institucional (PRI) party, the party that first nationalized the oil and gas industry, in an attempt to garner enough votes.[6] According to people close to Mexican political leaders, there is an increasing sense and concern that some version of the new reform will likely pass.

What This Means

We expect a vote will happen before December. If any version of the reform passes, it seems realistic to expect that:

- These actions violate the USMCA and will likely lead to reprisals not only from private firms, but from the US and Canadian governments as well.[7]

- This move would put at least $45 Billion USD of projects in jeopardy and may be considered expropriation of these projects under international law.[8]

- Mexico has set targets of reducing green-house gas emissions by 36% by 2030 through the Paris Climate Agreement. This energy reform likely eliminates any realistic scenario of achieving this given Administration prioritization to date.

- Power will be more expensive; CFE solar is already is 3x more expensive than that from the private sector according to data CRE.[9]

- For corporations, the dirtier and more expensive power comes with a third strike-it comes in clear contravention to their COP26 Goals.

- This is projected to be devastating for the Mexican economy as seen in a study conducted by the Consejo Coordinador Empresarial, the renewable energy industry has the potential to increase the Mexican GDP by $748 million USD by 2024, generate nearly 288,000 direct, long-lasting jobs, mitigate 55 Mt of CO2 equivalents, and generate massive savings for Mexican businesses and consumers.[10]

Moving Forward

If passed, the new energy reform proposal will negatively impact Mexico, international climate, clean energy, trade, and corporate interests for the US and US actors as well. The reforms will likely trigger many renewable energy firms to exit the Mexican power market and would hamper the ability for corporations and investors to meet clean energy and sustainability goals in Mexico. Renewable energy is a global growth engine that can fuel economic and community recovery and growth.

[1] https://mexicoelections.weebly.com/op-eds/a-pivotal-election-for-amlo-and-his-fourth-transformation

[2] https://www.argusmedia.com/en/news/2114825-mexico-aims-to-boost-fuel-oil-in-power-generation

[3] https://www.animalpolitico.com/elsabueso/cfe-energia-barata-limpia-reforma-electrica/

[4] https://www.bloomberg.com/opinion/articles/2021-10-12/under-lopez-obrador-mexico-s-energy-grid-risks-fading-to-black

[5] https://www.nrel.gov/docs/fy18osti/71531.pdf

[6] https://elpais.com/mexico/2021-10-06/la-reforma-electrica-de-lopez-obrador-abre-una-grieta-en-el-pri.html

[7] https://www.jdsupra.com/legalnews/2021-mexican-constitutional-reform-bill-6763325/

[8] https://www.wsj.com/articles/mexico-american-assets-obrador-amlo-energy-11634496785

[9] https://datos.gob.mx/busca/dataset/memorias-de-calculo-de-tarifas-de-suministro-basico

[10] Estudio De Energías Limpias En México 2018-2032. Consejo Coordinador Empresarial. https://amdee.org/Publicaciones/EstudiodeEnergiasRenovablesenMexico2018a2032_v16.pdf