Click here to read The Sol SOURCE June 2021.

The Sol SOURCE is a renewables journal that our team distributes to our network of clients and solar stakeholders. Our newsletter contains trends and observations gained through interviews with our team, incorporating news from a variety of industry resources.

Below, we have included excerpts from the June 2021 edition. To receive future Journals, please subscribe or email SOURCE@solsystems.com.

STATE MARKETS

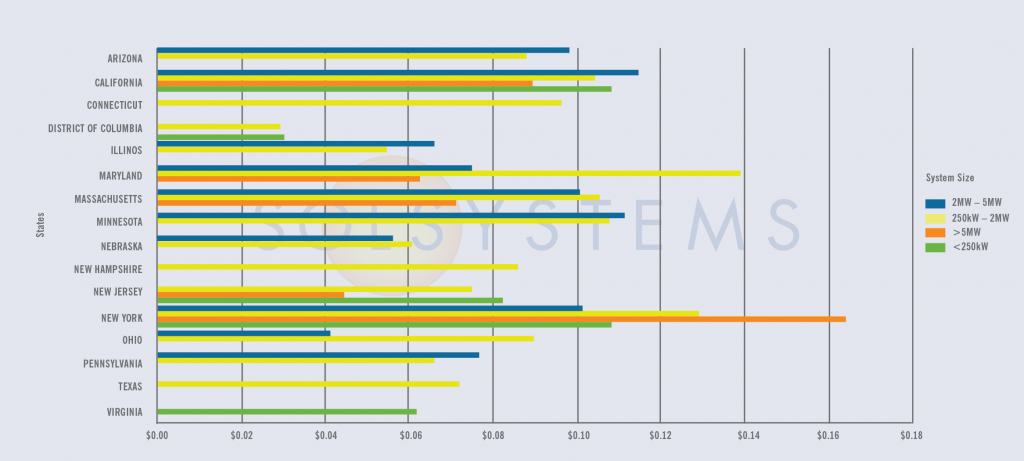

California – Net energy metering (NEM) enables solar energy owners to net the solar energy they produce against their retail rate and is the backbone for distributed generation. Each state has a slightly different variation, and California’s approach has always been complex, but largely favorable for solar. The search for California’s net metering successor program, NEM 3.0, officially began late last year and the California Public Utilities Commission (“CPUC”) is currently evaluating all NEM 3.0 proposals that were submitted by March 2021. Several pieces of legislation are now introduced that would revise California’s renewable portfolio standard, further electrify the transportation sector and clarify tax exemptions for solar and other renewable projects. As always, we continue to see many moving parts from the country’s clean energy leader, but we expect to see more clarity in the coming months, with a ruling on NEM 3.0 expected by Q4.

Delaware – The State of Delaware has had a challenging history with scaling renewable energy in the state and actually fulfilling (or implementing) its renewable portfolio standard (RPS). That is about to change. Governor Carney signed Senate Bill No. 33 (“SB 33”) on February 10, extending and expanding Delaware’s RPS. The bill made clarifying alterations to the RPS freeze requirements included in the previous statute, which historically caused controversy at the Public Service Commission (“PSC”). To read more about the bill and what it means for the state, check out our write up on it in the blogs section of SOURCE. In addition to Senate Bill No. 33, Senate Bill No. 2 - which would bring community solar to Delaware - recently passed the Senate, and the industry is watching to see what happens in the House. It’s shaping up to be a big year for solar in Delaware.

Illinois – The Prairie State is expanding on its historic commitment to solar. Toward the end of 2020, the Illinois Commerce Commission (“ICC”) issued a decision altering the calculation Ameren used to determine NEM penetration. This decision put Ameren below 3%, which is the threshold for re-evaluating the NEM compensation and the DG rebate rates. The ICC’s decision gives the industry more time to prepare for a future transition to a new NEM compensation rate. Yet, pending legislation in Springfield is expected to positively amend critical language regarding this proceeding. Specifically, Governor Pritzker and other state leaders are in negotiations regarding what will hopefully be an omnibus energy bill that among other things would refund the Adjustable Block Program (“ABP”) and increase the goals and funding. Without legislative action, the ABP will effectively come to a halt and new DG solar opportunities will disappear. As we understand it, the omnibus bill could change the 3% and 5% thresholds that trigger alterations to the NEM and DG rebate rates, the same triggers that are at issue in the Ameren proceeding. Overall, the package would provide necessary clarity to the industry on the potential to finance and develop future solar projects in Illinois and would send the message that Illinois is reopen for business. Negotiations on the bill are in the final stages, with some politicos predicting a vote within the next month which would mean Illinois could reopen the ABP before the end of the year.

Maine – You can’t get there from here…or maybe you can. As with any state’s first renewable incentive program, Maine is working out the kinks of its Net Energy Billing (“NEB”) framework with positive momentum. The state legislature has introduced several bills focusing on NEB reforms and working groups consisting of legislators, industry stakeholders, and members of Governor Mills’ office are beginning to work out how to deal with the high cost. Chairman Lawrence and Representative Grohski recently introduced amendments to L.D. 936 which would require Governor Mills’ Energy Office to submit an interim report on NEB alterations and impacts by January 2022. Notably, the language directs the Governor’s Energy Office to prioritize distributed generation that is sited on previously developed land (such as brownfields), within a low-to-moderate income community, or directly serving customer load. Separately, working groups have begun on how to deal with the high cost of projected interconnection upgrades and other issues that will come from legislative action.

Maryland – In 2019 the Maryland legislature passed the Clean Energy Jobs Act (“CEJA”), which included a solar carve-out of 14.5% by 2030. Unfortunately, as a result of Covid-19-related construction delays and price increases due to Federal tariffs, the industry has fallen short of meeting the incremental targets set out in the initial legislation. To ensure that the slow-down in development didn’t result in the payment of excessive solar alternative compliance payments (“SACP”) and a higher corresponding ratepayer impact, the industry rallied around reducing the solar carve-out to help reduce the number of SRECs needed, and therefore, the number of SACPs paid for a shortfall. With the extra head-room created by reducing the solar carveout, the industry was able to advocate for an increased SACP. The theory is that with a higher SACP, and hopefully corresponding increased SREC pricing, the industry will overcome the shortfall and be able to ramp up new in-state solar development.

Massachusetts – There is often an air of impending change in Massachusetts when it comes to clean energy and the laws that govern it. One of the most recent changes in Massachusetts is the passage of Senate bill 9 (“SB9”), which alters the RPS and modifies the Massachusetts climate roadmap. SB9 became law in March after a previous version of the bill failed at the end of last session. Notable provisions include a goal to hit net-zero GHG emissions by 2050, a 40% Class I RPS increase by 2030, an expansion of net metering, and the inclusion of property tax exemptions for certain renewable energy projects. At best, SB9 will provide long-term stability together with a greater focus on community impact. In addition to RPS alterations under SB 9, the state Department of Energy Resources (“DOER”) recently altered the regulations governing the RPS, which includes, among other things, shortening the life of SREC I systems retroactively to ten years and also reducing the Class I ACP. Finally, on the SMART-front, the industry continues to await proposed alterations to the program, which has undergone a rigorous review process.

New Hampshire – Legislators in the Granite State continue to attempt revisions to the existing RPS framework, most recently proposed under House Bill 213. This anti-clean energy bill would reduce the states RPS requirements for Class I, Class II, and Class III resources. In addition, the legislature circumvented a direct attack on the Community Power Law by amending House Bill 315 to protect competitive markets.

New Jersey – After months of stakeholder processes and input, in April, the Board of Public Utilities (“BPU”) released a straw proposal for the new SREC successor program and has actively sought feedback through stakeholder sessions which concluded in May. The industry is now waiting on the BPU to issue the next iteration of the successor program and is hopeful that stakeholder feedback will be incorporated. The timing of the release of future BPU successor program iterations is unclear, but we know the BPU is working to provide clarity as quickly as possible.

New York - Earlier this year, NYSEIA filed a joint petition asking the New York Public Utility Commission (“PUC’) to replenish the Community Credit Program, which suffered an unexpected reduction in capacity (180MW) when several natural gas-powered fuel cells where allowed to qualify for the credit. The industry urged the PUC to replenish the program through direct testimony and supportive comments and now awaits final decision from the PUC.

Pennsylvania – Solar energy is a hot topic in Harrisburg with several bills on the table to defend and increase the existing alternative energy portfolio standard (AEPS), legalize community solar, and reform grid scale solar procurement. Pennsylvania is a diverse energy production and generation state and therefore, lawmakers have many energy policy decisions to consider when deciding how best to maintain the State’s ability to remain a net energy exporter. However, solar and natural gas are the biggest drivers of newly installed electric generation capacity and therefore long-term policy certainty for solar is likely. However, the timing is still too early to predict, but it is clear that momentum is mounting.

Virginia –State regulators are continuing to make progress to implement the Virginia Clean Economy Act (“VCEA”). On Friday, April 30, the Virginia State Corporation Commission (“SCC”) released their orders in the Dominion and ApCo proceedings regarding the renewable portfolio standard ("RPS") established under the VCEA. In its orders, the SCC showed deference to Dominion and ApCo by approving almost every aspect of their plans. However, while their plans and projects were approved, the SCC clarified that for future plan filings the utilities will need to factor in REC-only options for RPS compliance which will provide more opportunity for third party developers.

SOLAR CHATTER

- President Biden released his Infrastructure Plan which includes a ten-year extension and phase down of an expanded investment tax credit and production tax credit for clean energy generation and storage. The plan aims to move the country toward 100 percent carbon-pollution-free power by 2035.

- Senator Ron Wyden of Oregon, Chair of the Senate Finance Committee, introduced a new bill that would eliminate tax breaks for fossil fuels and extend tax credits at 30 percent for any resource that allows the grid to become even cleaner, including solar, wind, and new credits for electric vehicles. This bill could have major implications on solar project financing, and represents a necessary step towards a robust, job-creating green economy needed to achieve Biden’s climate goals.

- The Solar Energy Industries Association (SEIA) released their US Solar Market Insight and according to the report, solar accounted for 43% of new energy generating capacity in 2020, which is the largest share of new generation among all electricity technology. Utility-scale solar had its largest year ever with 6.3 GW installed and will likely grow at an exponential rate with states, the federal government, utilities, and large corporates focused on achieving net zero carbon emissions.

- The US Power Sector is halfway to zero carbon emissions due to aggressive clean electricity policies and technological advancements by states and utilities, setting goals to reach 100% clean energy by 2050 or sooner. According to NREL, solar and wind exceeded performance, delivering over 13 times more generation than projected.

About Sol Systems

Sol Systems is a leading national solar energy firm with an established reputation for integrity and reliability across its development, infrastructure and environmental commodity businesses. To date, Sol has developed and/or financed over 1 GW of solar projects valued at more than $1 billion for Fortune 100 companies, municipalities, counties, utilities, universities and schools. The company also actively shapes and trades in environmental commodity and electricity markets throughout the United States. The company was founded in 2008, is based in Washington, D.C., and is led by its founder. Sol Systems works with its team, partners, and clients to create a more sustainable future we can all believe in. For more information, visit https://www.solsystems.com