Following suit from recent years, all SREC I and SREC II 2016 compliance-year solar renewable energy credits (SRECs) cleared in the first round of the Massachusetts Department of Energy Resources (DOER) Clearinghouse Auction on July 24th. The DOER’s auction is designed to support SREC pricing for solar energy system owners in the event of an SREC market oversupply. Need a refresher on how the auction works? Check out last year’s blog.

Round One & Done

Despite the large volume of SRECs deposited by sellers, both SREC I and SREC II auctions cleared in the first round. Combined auction deposit volume for SREC I and SREC II totaled 261,805 SRECs, representing $78,541,500 of value at a fixed clearing price of $300 ($285 net to sellers) for the 2016 compliance year.

Right before the 2016 auctions, DOER established a strong market signal to bidders by setting aggressive 2018 compliance-year demand targets. Since SRECs purchased in the 1st round can be banked into compliance-year 2018, the robust demand schedules are likely one of the main factors contributing to the success of this year’s auctions. Additionally, if the auctions proceeded to a third round, 2018 compliance-year demand would have increased automatically (providing yet another incentive for bidders with SREC obligations to acquire volume quickly).

How the Auction Works

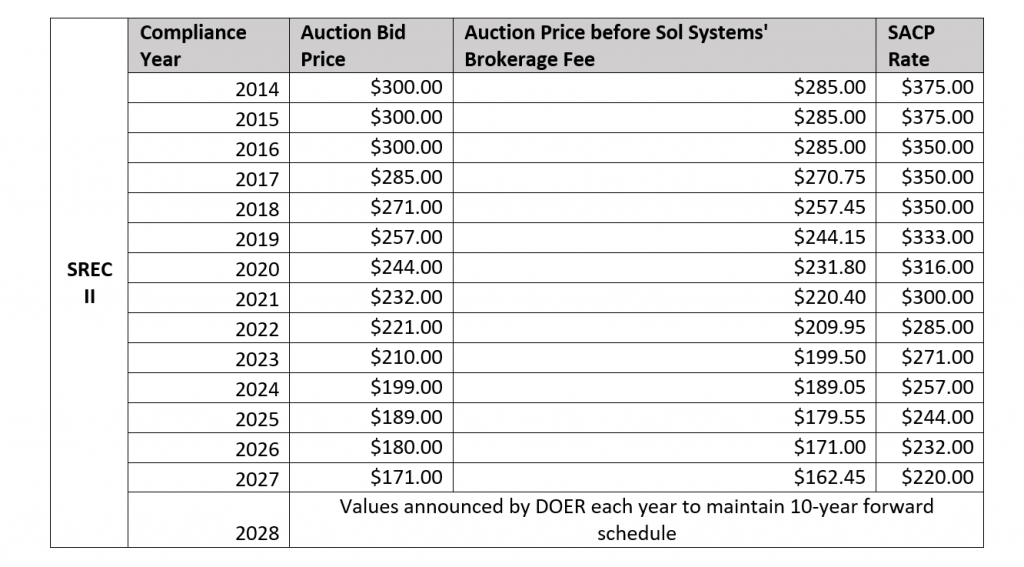

The Clearinghouse Auction is essentially the “last resort” for system owners to sell their SRECs at the end of a compliance year. In an oversupplied market, system owners must deposit unsold SRECs into the Clearinghouse. Each auction has a fixed bid price (reference table below) that compliance entities (“bidders”) must pay to purchase SRECs in the auction. Bidders submit their bids based on the volume of SRECs that they would like to purchase. If the cumulative bid volume is insufficient to clear the volume of SRECs deposited in the 1st round, the shelf life for the SRECs increases to three years and the value of the SRECs also increases. If the bid volume is insufficient to clear the volume of SRECs deposited in the 2nd round, the minimum standard (demand) for the following compliance year is increased by the total number of SRECs deposited into the auction. If this condition is still not met, the auction proceeds to a 3rd round and “fails”. In the 3rd round, partial volume can clear and demand in the following compliance year would increase, thereby creating bid interest and providing price support to the market. Due to the dynamics of the auction mechanism, there is an incentive for compliance entities to buy SRECs in Round 1. Otherwise, they risk higher compliance costs in future years if they are unable to procure enough SRECs for their RPS obligation.

What can we expect in future auctions?

Will future auctions continue to clear in the first round? Nobody knows for sure. However, we do know that there will continue to be auctions in years that SRECs are deposited into the Clearinghouse and oversupply exists. We also know that 2016 marks the last year of fixed auction prices at $300 for the MA SREC II market. From the 2017 compliance-year onward, the auction floor price will gradually decline per the following schedule:

The SREC I auction floor price will remain fixed at $300 ($285 net to sellers) for the continuation of the program. For more information on solar news in MA, please contact our team at info@solsystems.com or check out or blog. We’d be happy to speak with you.

ABOUT SOL SYSTEMS

Sol Systems, a national solar finance and development firm, delivers sophisticated, customized services for institutional, corporate, and municipal customers. Sol is employee-owned, and has been profitable since inception in 2008. Sol is backed by Sempra Energy, a $25+ billion energy company.

Over the last eight years, Sol Systems has delivered more than 600MW of solar projects for Fortune 100 companies, municipalities, universities, churches, and small businesses. Sol now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Inc. 5000 recognized Sol Systems in its annual list of the nation’s fastest-growing private companies for four consecutive years. For more information, please visit www.solsystems.com.